Introduction

Debt structuring is an essential aspect of corporate finance, involving the design and organization of borrowing arrangements to optimize costs, manage risks, and align with financial objectives. Advanced debt structuring techniques leverage innovative instruments, hybrid solutions, and strategic planning to address complex financial needs. This chapter delves into the principles, tools, and strategies for advanced debt structuring.

- Principles of Debt Structuring

1.1 Align Debt with Corporate Strategy

- Match debt maturities with project timelines or operational cash flows.

- Use tailored structures to support expansion, acquisitions, or restructuring.

1.2 Optimize the Cost of Capital

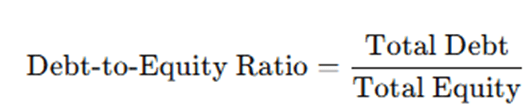

- Balance debt with equity to achieve an optimal capital structure.

- Minimize the weighted average cost of capital (WACC).

1.3 Diversify Funding Sources

- Mitigate risks by accessing multiple funding markets, such as bank loans, bonds, and alternative financing.

1.4 Manage Risks

- Incorporate hedging instruments to mitigate interest rate, currency, and liquidity risks.

- Advanced Debt Structuring Techniques

2.1 Hybrid Financing Instruments

- Convertible Bonds:

- Combine debt with an option to convert into equity at a later date.

- Offer lower interest rates and appeal to investors seeking potential equity upside.

- Perpetual Bonds:

- Debt with no fixed maturity, often used for long-term financial stability.

- Provides flexibility in repayment while maintaining a debt-like structure.

2.2 Mezzanine Financing

- A mix of debt and equity financing that ranks below senior debt but above equity.

- Commonly used in leveraged buyouts or high-risk, high-reward projects.

2.3 Asset-Backed Securities (ABS)

- Securitize receivables, loans, or other cash-generating assets to raise funds.

- Provide access to a broader range of investors.

2.4 Syndicated Loans

- Loans provided by a group of lenders to distribute risk and fund large-scale projects.

- Offer flexibility in terms, pricing, and structure.

2.5 Structured Bonds

- Bonds with embedded options, such as call or put features, to align with issuer needs.

- Example: Callable bonds allow issuers to redeem bonds early if interest rates decline.

- Tools for Advanced Debt Structuring

- Debt Modeling Software:

- Simulate scenarios to evaluate debt structures and risks.

- Treasury Management Systems (TMS):

- Automate tracking, compliance, and reporting for complex debt portfolios.

- Financial Advisors and Underwriters:

- Provide expertise in designing and issuing complex debt instruments.

Conclusion

Advanced debt structuring enables organizations to achieve financial flexibility, reduce costs, and manage risks effectively. By leveraging innovative instruments and strategic planning, companies can address diverse financial challenges while supporting growth objectives.

Leave a Comment

You must be logged in to post a comment.