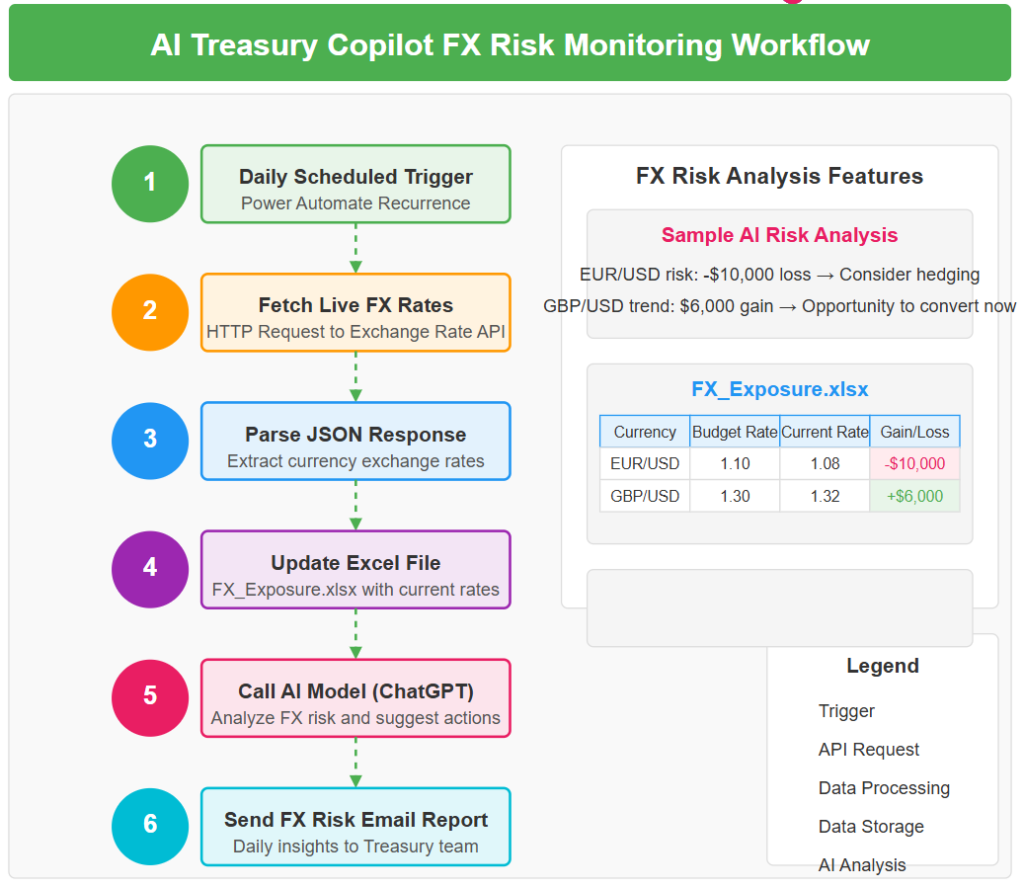

In this guide, we’ll build a no-code FX Risk Monitoring Copilot that helps treasury professionals track exchange rate fluctuations, analyze currency exposures, and receive AI-generated risk insights automatically.

What Will This Copilot Do?

✅ Fetch real-time FX rates automatically.

✅ Compare actual vs. budgeted exchange rates.

✅ Calculate potential FX gains/losses.

✅ Allow interactive Q&A with ChatGPT about currency risks.

What You Need

No coding or IT support is required. You only need:

🔹 Microsoft Excel (for currency exposure data)

🔹 Power Automate (to automate data collection)

🔹 ChatGPT / Microsoft Copilot (for AI insights)

🔹 Power BI (optional) for visualizing FX trends

Step-by-Step Guide to Building Your FX Risk Monitoring Copilot

Step 1: Set Up an FX Exposure Data File

Create an Excel file called “FX_Exposure.xlsx” with the following structure:

| Date | Currency | Budgeted Rate | Current Rate | Exposure (USD) | Gain/Loss (USD) |

|---|---|---|---|---|---|

| 01/02/2025 | EUR/USD | 1.10 | 1.08 | 500,000 | ? |

| 01/02/2025 | GBP/USD | 1.30 | 1.32 | 300,000 | ? |

🔹 Save this file on OneDrive or SharePoint for Power Automate to access.

Step 2: Fetch Live FX Rates Automatically

We will automate the collection of real-time exchange rates from an API.

🔹 Set Up Power Automate Flow

Go to Power Automate → Create an “Automated cloud flow”.

Trigger: Select “Recurrence” (schedule it to run daily).

Action: Choose “HTTP Request”, and use a free FX API like ExchangeRate-API.

- API URL:

https://v6.exchangerate-api.com/v6/YOUR_API_KEY/latest/USD

Action: Use “Parse JSON” to extract FX rates.

Action: Update FX_Exposure.xlsx with the latest exchange rates.

Now, your spreadsheet will always have up-to-date FX rates.

Step 3: Calculate FX Gains/Losses Automatically

In Excel, add a simple formula to compute gains/losses:

Formula for Gain/Loss (USD): (Current Rate - Budgeted Rate) * Exposure

Now, every time the Power Automate flow updates exchange rates, your FX gains/losses will be recalculated automatically.

Step 4: Use AI to Generate FX Risk Insights

We will use ChatGPT in Power Automate to analyze currency risk.

🔹 Add AI-Powered FX Analysis in Power Automate

Create a new step in Power Automate: “Call an AI model” (OpenAI / ChatGPT).

Send a prompt to ChatGPT with the latest FX data:

Example Prompt:

“Analyze the FX exposure data for today. Identify the biggest risk and suggest actions to minimize potential losses.”

Step 5: Automate FX Risk Reports via Email

In Power Automate, create a new step: “Send an email”.

Set recipient: Treasury team members.

Attach AI insights and key FX risk trends.

🔹 Example Email Output:

Subject: FX Risk Update – [Today’s Date]

EUR/USD risk: -$10,000 loss → Consider hedging

GBP/USD trend: $6,000 gain → Opportunity to convert now

Step 6: Ask AI Questions About FX Risk

Now that AI is monitoring FX risk, you can ask real-time questions.

Use Microsoft Copilot or ChatGPT in Excel

- Open Copilot and type:

“What is the total FX exposure this month?” - Or in ChatGPT, upload your FX_Exposure.xlsx and ask:

“Which currency poses the highest risk this week?”

Attention: Microsoft Copilot in Excel is powerful but still has limitations—especially when dealing with finance-specific terms. If Copilot struggles in Excel, you can try Power BI and use “Quick Insights” to generate trends.

Considerations and Limitations:

It’s essential to approach AI integration thoughtfully:

- Data Quality: The effectiveness of AI models heavily depends on the quality of data input. Inaccurate or incomplete data can lead to misleading analyses.

- Model Transparency: Understanding how AI models arrive at specific conclusions is crucial, especially in financial contexts where decisions must be justified.

- Continuous Monitoring: AI tools require regular updates and monitoring to ensure they adapt to changing market conditions and continue to provide relevant insights.

While the benefits of using AI are significant, it’s vital for organizations to implement such tools with careful consideration of data integrity, model transparency, and ongoing maintenance to fully realize their potential.

Leave a Comment

You must be logged in to post a comment.