The ‘Next Big Thing’ Syndrome Every time a new technology shows up, blockchain, RPA, AI, or the latest agentic AI, the same scene plays out. Within days, LinkedIn is full of visionaries and overnight experts explaining to us mere...

Author - Alina Turungiu

CAMT.053 Transaction Processor

Instantly Decode CAMT.053 Files – No Coding, No Uploads Say goodbye to manual parsing of complex XML bank statements.The CAMT.053 Transaction Processor is a browser-based tool designed to help treasury professionals instantly...

CAMT.053 Fee Analyzer

Instantly Detect Hidden Bank Charges What It Does This lightweight app lets treasury teams, accountants, and finance professionals upload CAMT.053 XML files and instantly identify all fee-related transactions (commissions...

AI Treasury Prompt Pack

The Complete Prompt Guide for Smarter Cash, Risk & Compliance — Without Writing a Single Line of Code What if AI could reduce your reporting time by 70% and help you spot cash risks before they happen? What If AI Could Cut...

MT101 to Pain.001: Treasury Migration Guide

In my previous article (link here), I explained the difference between MT940 and CAMT.053, in other words, how you see the cash. Now it’s time to talk about how you move it. This article breaks down MT101 vs. Pain.001 — the old...

MT940 vs CAMT.053: Guide to Bank Statement Migration & Automation

CAMT.053 and CAMT.052 are emerging as the new standards for bank statements, widely promoted as game changers for cash management and reconciliation efficiency. Understanding the Migration: MT940 vs CAMT The Real Difference MT940...

5 Treasury Tasks That Waste 10+ Hours Per Week (And How to Fix Them)

After 12 years in treasury, I’ve seen the same pattern everywhere: talented treasury professionals drowning in manual tasks that could be automated with the right tools. The irony? Most of these solutions don’t...

TMS Reality Check: What Treasury Systems Really Do (and Don’t)

I’ve worked with four different Treasury Management Systems over 10 years. Each came with glossy presentations promising to “revolutionize our treasury operations” and “deliver real-time visibility across...

Trapped Cash: How to Reveal True Liquidity in Treasury

Recently, I came across a scenario that illustrates a common treasury challenge: a company planned a $50 million strategic expansion based on $180 million in reported global cash. But once they dug deeper, they realized only $35...

Treasury Transfer Pricing: Complete Guide and Calculator

Understanding Transfer Pricing in Treasury Transfer pricing in treasury is the methodology for determining the internal cost of funds between different business units, subsidiaries, or geographical regions within a multinational...

Cash Pool Simulator

Optimize your corporate cash management with our advanced Cash Pool Simulator. This powerful financial tool helps treasury professionals analyze and compare different cash pooling strategies to maximize interest savings and...

Multi-Currency Notional Pooling Business Case ROI

The Hidden Cost of Cash Fragmentation For multinational companies, managing liquidity across entities and currencies is often more chaotic than strategic. Consider this typical case: €22.5M in idle cash earning negligible returns...

Multi-Currency Notional Pooling – ROI Sensitivity Analysis Tool

Stress-Test Your MCNP Business Case Before You Commit Multi-Currency Notional Pooling (MCNP) is one of the most advanced liquidity optimization techniques available to multinational companies. But implementation outcomes vary...

Mastering Multi-Currency Notional Pooling (MCNP): A Practical Treasury Guide

What is MCNP and Why Should You Care? Imagine having a virtual treasury command center where all your global cash positions speak to each other instantly, without moving a single dollar physically. That’s exactly what Multi...

Treasury Automation ROI Calculator

Discover How Much Treasury Automation Can Save Your Organization Still wondering if treasury automation is worth the investment? Spending countless hours on manual processes that could be automated? Stop guessing and get concrete...

In-House Banking: A Treasury Technology Implementation Guide

What Is In-House Banking? In-house banking is a centralized structure where your corporate headquarters acts as an internal bank for all subsidiaries and business units. Instead of each subsidiary maintaining separate banking...

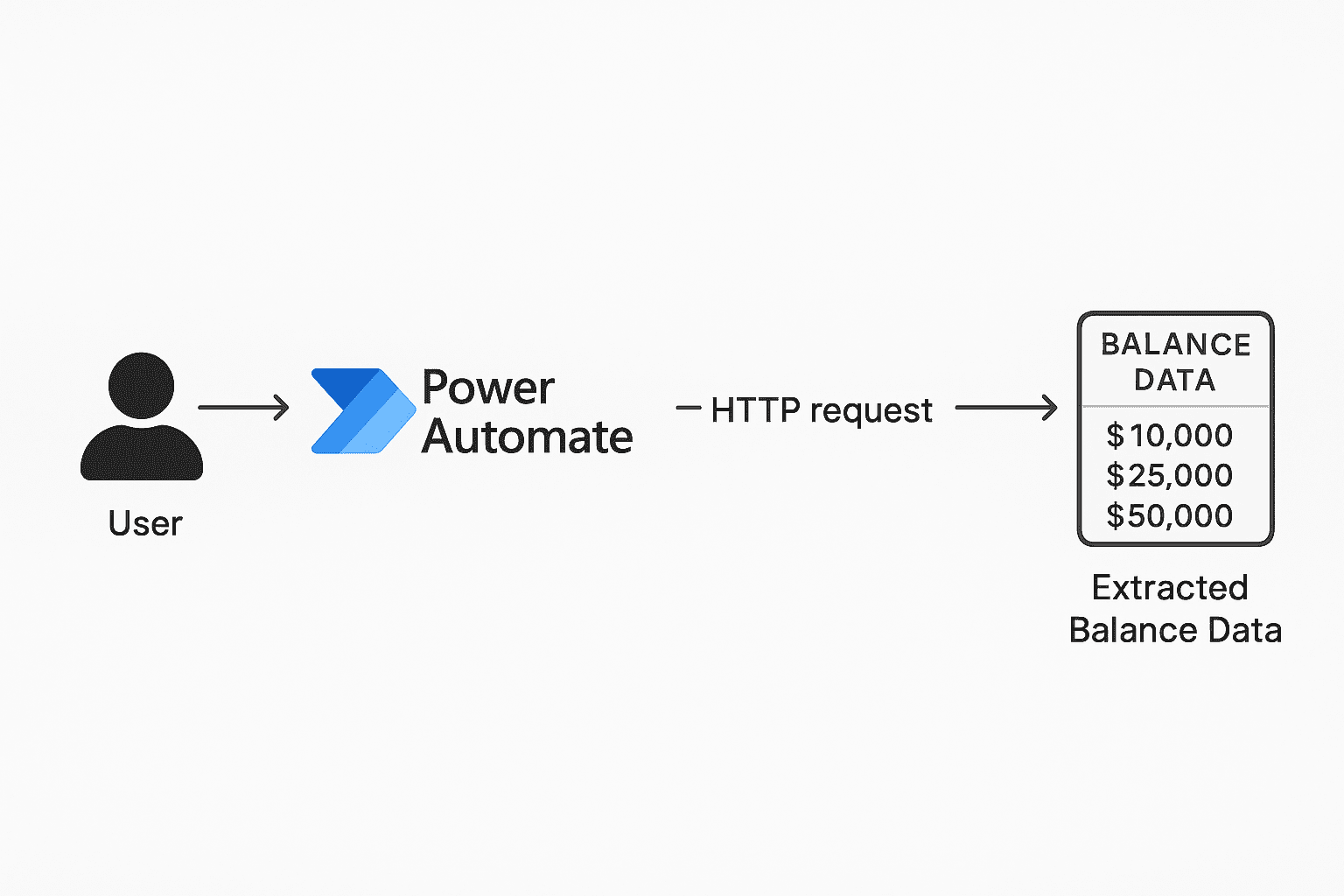

Building Your First Treasury API: Kyriba Balance Extraction with Power Automate

A Step-by-Step Implementation Guide Following the Treasury API Manual Introduction This practical guide demonstrates how to implement the concepts from our Treasury API Guide: A Non-Technical Treasurer’s Complete Manual...

Treasury API Guide: A Non-Technical Treasurer’s Complete Manual

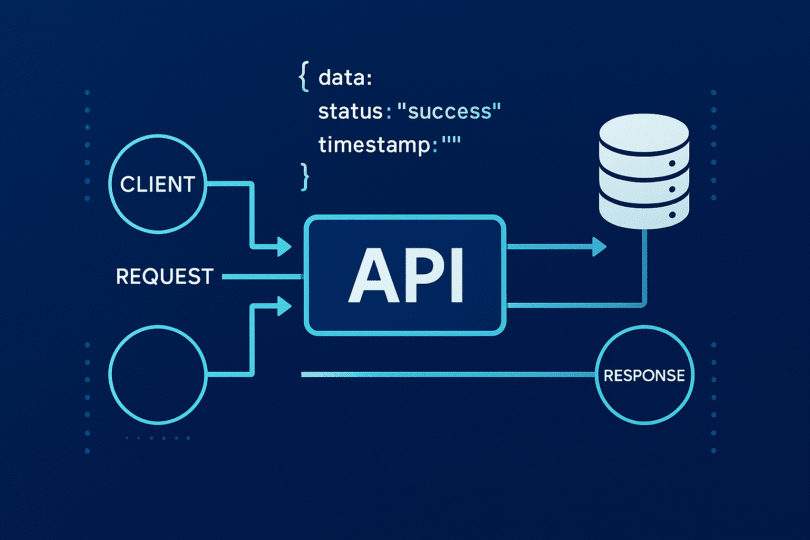

What is an API and Why Should Treasurers Care? An API (Application Programming Interface) is essentially a digital messenger that allows two software systems to talk to each other automatically. Think of it as a waiter in a...

Treasury API Cheat Sheet

Treasury API Cheat Sheet Quick Reference Guide for Non-Technical Treasurers 🔧Essential API Components Component Purpose Treasury Example Endpoint Where to send request api.bank.com/v1/accounts Method Type of request GET...

Understanding Treasury Technology

What is Treasury Technology? Treasury Technology is the integrated ecosystem of systems, tools, platforms, and infrastructure that supports the management of a company’s cash, liquidity, risk, banking relationships, and...

How to Build a Treasury AI Copilot in Microsoft 365 – No Code, No IT Required

As a treasury professional, you’re constantly juggling cash flow management, risk analysis, investment decisions, and complex financial reporting. What if you could have a digital assistant that understands treasury...

The Future of B2B Payments: Blockchain & Smart Contracts

Maybe in 20 years – or less, who knows – the today payment systems will be only history. Let’s face it: in today’s digital economy, businesses still face surprisingly archaic payment systems. Cross-border...

Building Your Own Treasury Bot for Working Capital Optimization: A Non-Technical Guide

Treasury operations are complex, with working capital optimization requiring daily attention to cash positions, liquidity management, and forecasting. While many solutions exist, they often require technical expertise, IT...

Deploying Your Private Treasury GPT with RAG: A Complete Guide for Non-Technical Users

Introduction As a treasury professional, you’re managing complex financial operations daily – cash forecasting, FX risk, investment strategies, and more. While AI assistants can improve efficiency, using public AI...

Building a GPT for a Treasury Department

Generative AI in Treasury can handle complex technical work behind the scenes while presenting a simple, conversational interface to the treasury professional. It gets all the benefits of advanced analytics and AI without needing...

Building a Treasury Bot for Payment Approval Automation

Introduction As a treasury professional, you’re likely juggling multiple payment approvals daily – from vendor payments (if performed by Treasury department) to intercompany transfers, payroll authorizations to tax...

Transforming Treasury Operations: A Comprehensive Guide to Modernization and Automation

In today’s rapidly evolving financial landscape, Treasury departments face increasing pressure to do more with less while maintaining accuracy and compliance. Traditional manual processes are giving way to streamlined...

Bank Reconciliation Automation Copilot Series – Part 2: Building the Automation Logic

Introduction Welcome to Part 2 of Bank Reconciliation Automation series. In Part 1, we established the foundation by standardizing your data structures across different banks and ERP systems. Now we’ll build the actual...

Treasury Automation Maturity Assessment

Is Your Treasury Team Truly Automated? Take the Treasury Automation Maturity Assessment! Treasury automation is no longer a luxury—it’s a necessity. But how automated is your treasury function really? Many treasury teams believe...

Bank Reconciliation Automation Copilot Series – Part 1: Data Structure and Preparation

Introduction Bank reconciliation is the cornerstone of treasury operations, ensuring that your company’s financial records match your bank’s records. Without direct bank connections through SWIFT or APIs, this process...

AI in Treasury: A Powerful Tool for Automation, Not a Replacement

AI and automation are reshaping treasury operations. From cash forecasting to FX risk management and KYC compliance, AI-driven solutions are making treasury processes faster, more accurate, and less manual. But there’s a...

Episode 5: How to Build a Treasury Bot for Hedging Recommendations

Introduction Managing FX risk efficiently is critical for any treasury department. A bot that provides hedging recommendations can help reduce risk exposure and optimize hedge strategies. This article will guide you through...

Episode 4: How to Build a Treasury Bot for Cash Pooling Automation – No Coding Required

Introduction Cash pooling is an essential Treasury function, ensuring liquidity optimization and efficient fund utilization. Typically, a cash pool is managed by a bank, allowing companies to centralize liquidity management...

Episode 3: How to Build a Treasury Bot for Investment Tracking Without Coding

In treasury, tracking investments efficiently is crucial but often involves manual work in Excel or outdated systems. This guide shows you step-by-step how to create a Treasury Bot for investment tracking—without coding or IT...

TreasuryBot: The Low-Cost, Low to No-Code Treasury Automation Tool for SMEs

What is a TreasuryBot? TreasuryBot is a low-cost, no-code automation tool designed to help SMEs streamline their cash flow management, payments, and reconciliations without requiring a Treasury Management System (TMS) or ERP...

Episode 2: How to Build an AI Treasury Copilot for FX Risk Monitoring (No Coding Required)

In this guide, we’ll build a no-code FX Risk Monitoring Copilot that helps treasury professionals track exchange rate fluctuations, analyze currency exposures, and receive AI-generated risk insights automatically. What Will This...

Episode 1: How to Build an AI Treasury Copilot for Automation & Decision-Making—Low/No Code

Introduction AI-powered automation is transforming treasury operations by reducing manual tasks, improving forecasting accuracy, and enhancing decision-making. With today’s no-code and low-code tools, you can build a...

Unlocking Treasury Automation: Building a Data Repository Without an ERP

Managing treasury data often feels like juggling flaming torches while riding a unicycle. Large corporations invest heavily in expensive ERP systems to centralize financial operations, but here’s the good news—you don’t have to...

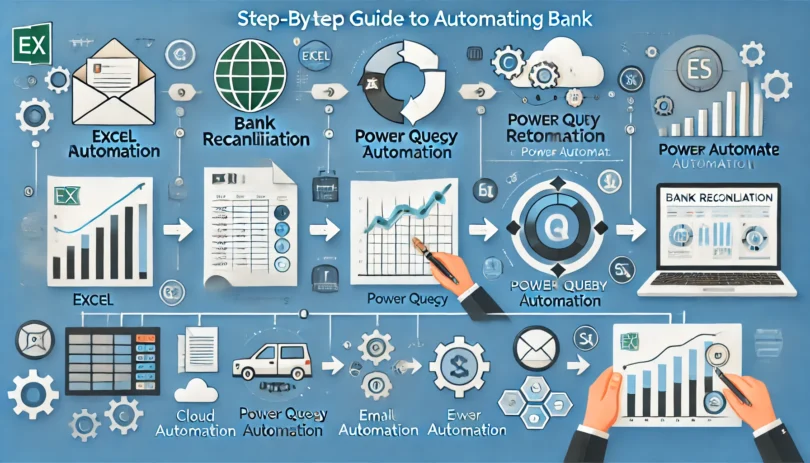

Step-by-Step Guide to Automating Bank Reconciliation Using Excel, Power Query, or Power Automate

Bank reconciliation is one of the most time-consuming tasks in treasury and finance departments. Many companies still rely on manual processes, spending hours comparing bank statements with accounting records. However, automation...

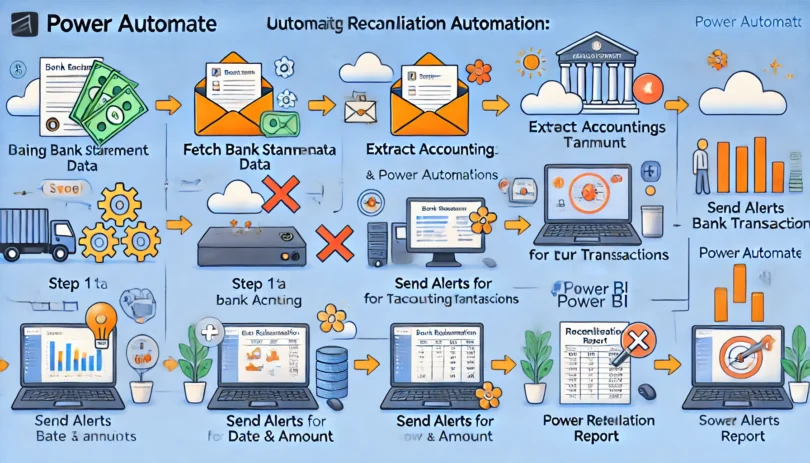

Step-by-Step Guide: Automating Bank Reconciliation Using Power Automate (Cloud Flow and Desktop)

This guide will help you set up an automated reconciliation flow that: Fetches bank statements from an email attachment or SharePoint folder. Extracts accounting transactions from an Excel file or ERP. Compares transactions and...