Introduction

The implementation of forecasting methods, whether traditional or advanced, determines their effectiveness. Best practices ensure that the chosen approaches are executed smoothly and deliver actionable insights. This chapter outlines strategies for successful implementation.

- Establishing a Foundation

1.1 Define Objectives

- Clearly articulate the purpose of the forecast (e.g., liquidity management, risk mitigation).

- Align forecasting goals with broader organizational strategies.

1.2 Ensure Data Quality

- Standardize data collection processes across departments.

- Use data validation techniques to eliminate inaccuracies.

1.3 Involve Key Stakeholders

- Foster collaboration between finance, sales, operations, and treasury teams.

- Incorporate feedback from all relevant departments to refine assumptions.

- Selecting the Right Tools

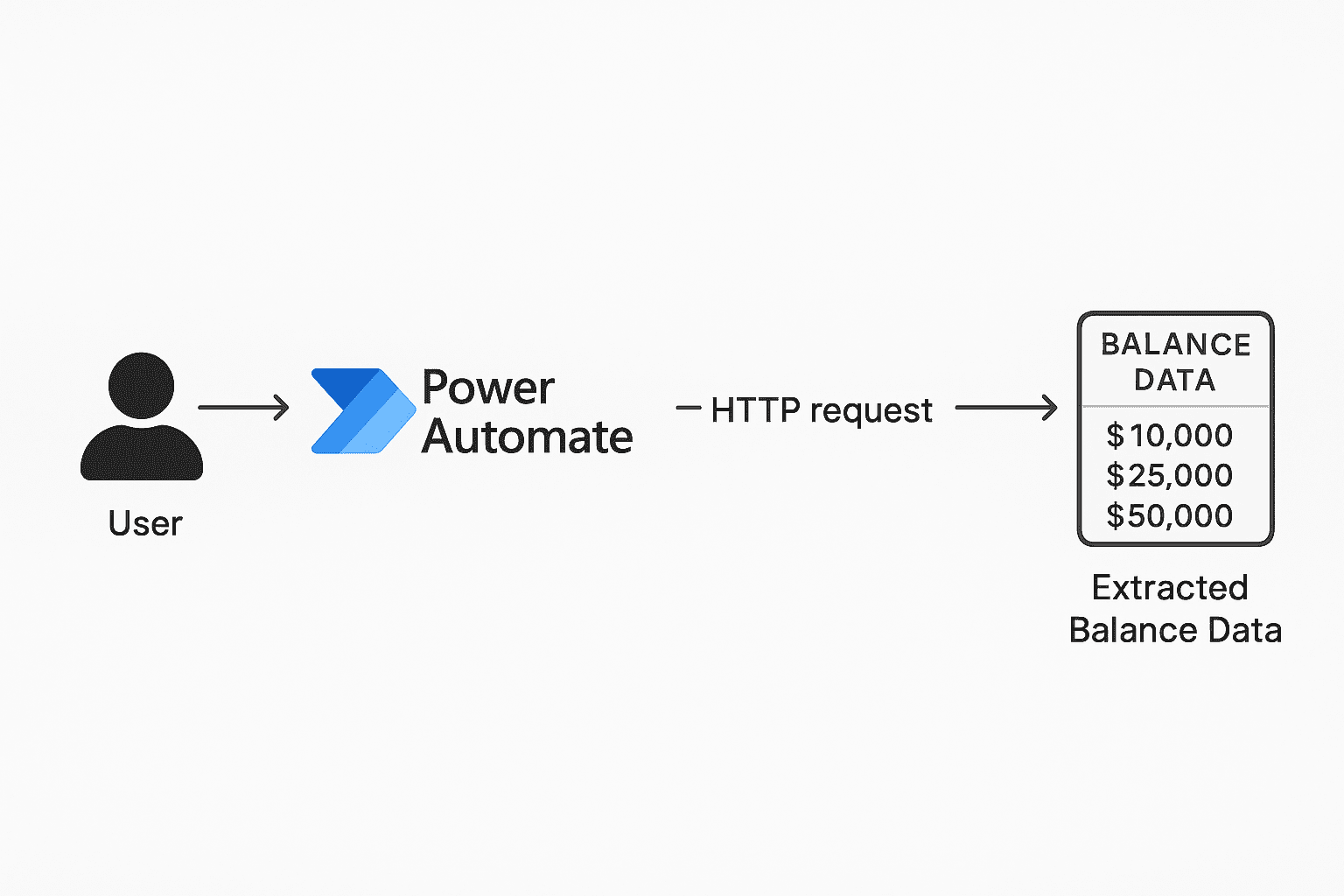

2.1 Automation

- Use Treasury Management Systems (TMS) to streamline data aggregation and analysis.

- Examples: Kyriba, SAP Treasury, Adaptive Insights.

2.2 Integration

- Ensure forecasting tools integrate seamlessly with existing ERP and accounting systems.

- Enable real-time data feeds for accurate, up-to-date inputs.

2.3 User-Friendly Platforms

- Choose tools with intuitive interfaces to encourage adoption across the organization.

- Building Forecasting Expertise

3.1 Training and Development

- Provide regular training sessions on forecasting tools and methodologies.

- Encourage cross-functional learning to enhance collaboration.

3.2 Establish Forecasting Teams

- Designate a team responsible for overseeing the forecasting process.

- Include individuals with expertise in data analysis, finance, and risk management.

- Monitoring and Refining the Forecast

4.1 Regular Updates

- Schedule periodic reviews to ensure forecasts remain relevant.

- Incorporate new data and adjust for unforeseen changes.

4.2 Performance Tracking

- Measure the accuracy of forecasts against actual results.

- Use metrics like forecasting error rates and timeliness to identify areas for improvement.

4.3 Feedback Loops

- Gather input from users and stakeholders to refine forecasting processes continually.

Conclusion

Implementing forecasting methods effectively requires clear objectives, the right tools, and a commitment to continuous improvement. Following these best practices ensures forecasts are accurate, actionable, and aligned with organizational needs.

Case Studies of Successful Real-World Applications

Introduction

Learning from real-world examples provides invaluable insights into the practical application of forecasting methods. This chapter highlights case studies that demonstrate the challenges, solutions, and outcomes of implementing effective forecasting processes.

- Case Study: Retail Chain – Rolling Forecasts for Seasonal Planning

Scenario:

- A global retail chain struggled with cash flow volatility during holiday seasons.

Solution:

- Implemented rolling forecasts to continuously update projections.

- Used predictive analytics to model seasonal sales and expenses.

Outcome:

- Improved inventory management and avoided cash shortages.

- Reduced reliance on short-term borrowing by 15%.

- Case Study: Manufacturing Company – Scenario Analysis for Risk Management

Scenario:

- A manufacturing firm faced risks from fluctuating raw material costs and supply chain disruptions.

Solution:

- Conducted scenario analysis to model the financial impact of cost increases.

- Developed contingency plans based on forecasted cash flow gaps.

Outcome:

- Maintained production continuity during supply chain disruptions.

- Strengthened relationships with suppliers by ensuring timely payments.

- Case Study: Tech Startup – AI-Powered Forecasting for Rapid Growth

Scenario:

- A tech startup experienced unpredictable cash flows due to rapid scaling and high R&D expenses.

Solution:

- Deployed AI-driven forecasting tools to predict revenue streams and expenses.

- Integrated real-time data from sales and operations into the forecasting model.

Outcome:

- Achieved 95% forecasting accuracy.

- Secured funding on time, avoiding liquidity crises during growth phases.

- Case Study: Energy Sector – Monte Carlo Simulation for Investment Planning

Scenario:

- An energy company needed to evaluate the cash flow impact of investing in renewable energy projects.

Solution:

- Used Monte Carlo simulations to model a range of outcomes based on varying market conditions.

- Assessed risks and potential returns under different scenarios.

Outcome:

- Made informed decisions on project prioritization.

- Mitigated risks by building financial buffers based on probabilistic insights.

Conclusion

These case studies illustrate how organizations across industries have successfully implemented forecasting methods to overcome challenges and optimize financial outcomes. By leveraging advanced tools, best practices, and collaborative efforts, businesses can achieve similar success.

Leave a Comment

You must be logged in to post a comment.