Treasury operations are complex, with working capital optimization requiring daily attention to cash positions, liquidity management, and forecasting. While many solutions exist, they often require technical expertise, IT involvement, or direct bank connectivity. This guide shows you how to build your own Treasury Bot that automates key processes, provides actionable insights, and optimizes working capital – all without writing a single line of code or requiring IT department support.

What This Treasury Bot Will Do

- Consolidate financial data from multiple sources (bank statements, ERP exports, etc.)

- Automate cash position reporting and forecasting

- Optimize working capital by identifying idle cash and investment opportunities

- Alert you to potential cash shortfalls or excess liquidity situations

- Generate actionable recommendations for treasury decisions

- Improve DSO (Days Sales Outstanding) and DPO (Days Payable Outstanding) metrics

The Building Blocks: No-Code Tools You’ll Need

- Data Automation Platform: Microsoft Power Automate. If not available, you can use Zapier, or Make (formerly Integromat).

- Spreadsheet Solution: Microsoft Excel or Google Sheets

- Business Intelligence Tool: Power BI, Tableau Public, or Google Data Studio

- Document Processing Tool: ABBYY FineReader, Adobe Acrobat Pro, or Docparser if statement is sent in PDF. Otherwise, Power Automate/ Zapier/ Make for Excel format.

- Communication Channel: Email or Microsoft Teams/Slack for alerts

Step 1: Setting Up Your Data Collection Process

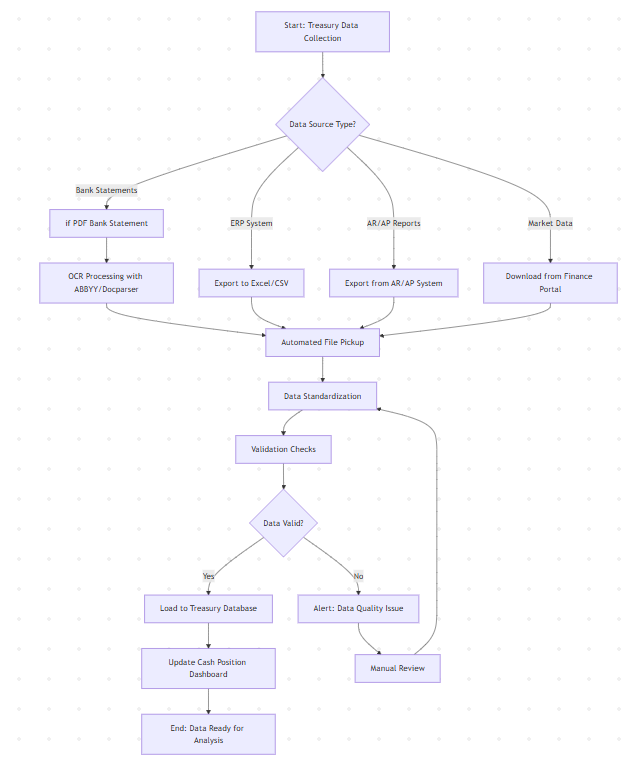

Treasury Bot Data Collection Workflow

For a better view, open the below code in your Mermaid Editor:

flowchart TD

A[Start: Treasury Data Collection] --> B{Data Source Type?}

B -->|Bank Statements| C[if PDF Bank Statement]

B -->|ERP System| D[Export to Excel/CSV]

B -->|AR/AP Reports| E[Export from AR/AP System]

B -->|Market Data| F[Download from Finance Portal]

C --> G[OCR Processing with ABBYY/Docparser]

D --> H[Automated File Pickup]

E --> H

F --> H

G --> H

H --> I[Data Standardization]

I --> J[Validation Checks]

J --> K{Data Valid?}

K -->|Yes| L[Load to Treasury Database]

K -->|No| M[Alert: Data Quality Issue]

M --> N[Manual Review]

N --> I

L --> O[Update Cash Position Dashboard]

O --> P[End: Data Ready for Analysis]Without direct bank connections via SWIFT or APIs, you’ll need to establish a semi-automated process for data collection:

For Bank Statement Data:

- Create a dedicated email account where bank statements can be received (e.g., treasury@yourcompany.com)

- Set up automated email rules in your data automation platform to detect and download bank statement attachments

- Configure a process to extract from your Excel or PDF statements key data:

- Account numbers and names

- Transaction dates, descriptions, and amounts

- Opening and closing balances

- Value dates for forecasting purposes

For ERP and Financial System Data:

- Create standardized export templates for consistent data extraction

- Schedule automated exports to a shared folder (daily/weekly as needed)

- Set up a file watcher in your automation tool to detect new files

- Configure data transformation rules to standardize formats across systems

Step 2: Building Your Cash Position Consolidation Engine

The core of your Treasury Bot is the cash position consolidation. Here’s how to build it without coding:

Create Your Cash Position Database in Excel:

- Create a master template with the structure shown above

- Set up validation rules for data integrity:

- Account numbers must match your chart of accounts

- Transaction categories must use standardized classifications

- Currency codes must be valid ISO codes (EUR, USD, GBP….)

- Build dynamic named ranges for easier reference and formula maintenance

- Create data connection queries to import the processed data from your automation tool

Automation Rules to Implement:

- Daily data consolidation at a set time (e.g., 8:00 AM)

- Data cleansing steps:

- Remove duplicate transactions by transaction reference

- Match and reconcile opening/closing balances

- Flag outlier transactions (unusually large amounts)

- Automated calculations:

- Working capital metrics (e.g: DSO, DPO, DIO, Cash Conversion Cycle)

- Liquidity ratios (e.g: Current Ratio, Quick Ratio)

- Cash flow forecasts based on historical patterns and scheduled payments

Step 3: Building Your Cash Forecasting Engine

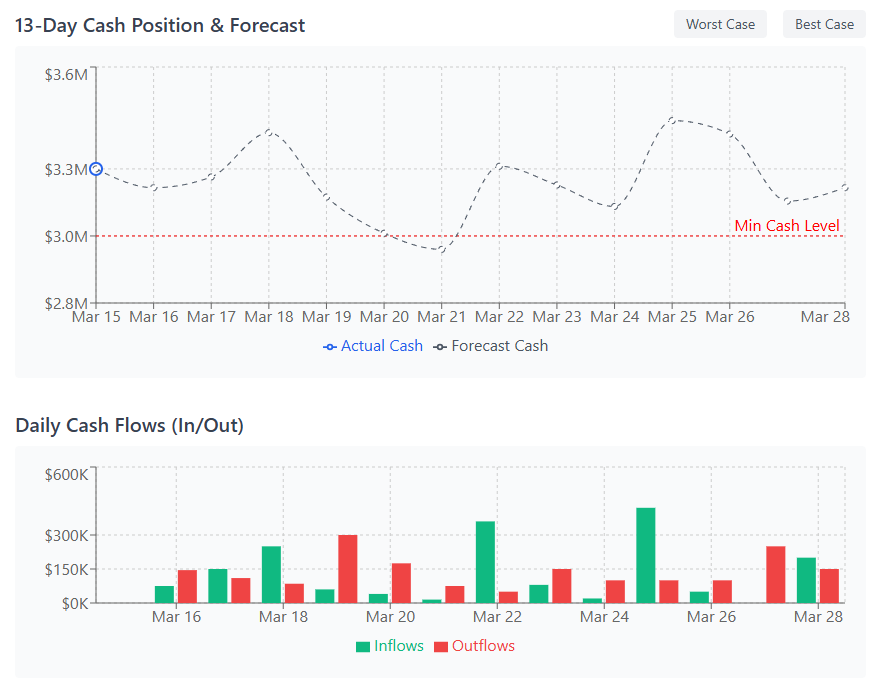

Treasury Bot Cash Flow Forecasting Dashboard could look like:

For effective cash forecasting without direct bank connections:

- Build a structured forecast template in Excel with these components:

- Historical Transaction Analysis: Categorize and analyze past cash flows

- Recurring Payment Schedule: Track regular payments (payroll, rent, etc.)

- AR/AP Aging Reports: Convert to expected cash flows

- Probability-Weighted Forecast: Assign probability to uncertain flows

- Create forecasting rules based on business patterns:

- Customer Payment Behavior: Analyze historical payment patterns by customer

- Supplier Payment Terms: Track actual vs. contractual payment timing

- Seasonality Factors: Adjust for known business cycles

- Foreign Exchange Impact: Include currency fluctuation scenarios

- Set up automated data refreshes:

- Configure your automation tool to update forecasts daily

- Implement variance analysis between forecast and actual

- Create a feedback loop to improve future forecasts

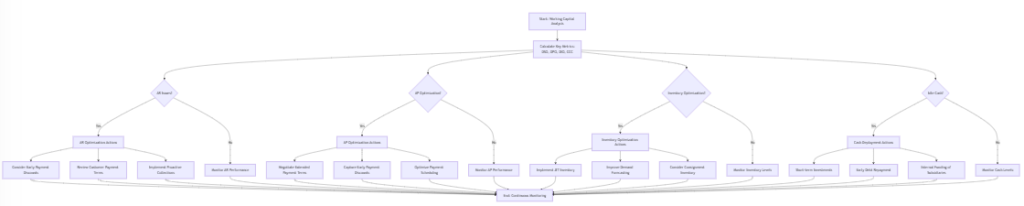

Step 4: Working Capital Optimization Rules

Paste below code in Mermaid Editor to see the above diagram:

flowchart TD

Start[Start: Working Capital Analysis] --> MetricsCalc[Calculate Key Metrics:

DSO, DPO, DIO, CCC]

MetricsCalc --> ARCheck{AR Issues?}

MetricsCalc --> APCheck{AP Optimization?}

MetricsCalc --> InvCheck{Inventory Optimization?}

MetricsCalc --> CashCheck{Idle Cash?}

ARCheck -->|Yes| ARActions[AR Optimization Actions]

ARCheck -->|No| ARMonitor[Monitor AR Performance]

ARActions --> ARDiscount[Consider Early Payment Discounts]

ARActions --> ARTerms[Review Customer Payment Terms]

ARActions --> ARCollection[Implement Proactive Collections]

APCheck -->|Yes| APActions[AP Optimization Actions]

APCheck -->|No| APMonitor[Monitor AP Performance]

APActions --> APTerms[Negotiate Extended Payment Terms]

APActions --> APDiscount[Capture Early Payment Discounts]

APActions --> APSchedule[Optimize Payment Scheduling]

InvCheck -->|Yes| InvActions[Inventory Optimization Actions]

InvCheck -->|No| InvMonitor[Monitor Inventory Levels]

InvActions --> JIT[Implement JIT Inventory]

InvActions --> InvForecast[Improve Demand Forecasting]

InvActions --> InvConsign[Consider Consignment Inventory]

CashCheck -->|Yes| CashActions[Cash Deployment Actions]

CashCheck -->|No| CashMonitor[Monitor Cash Levels]

CashActions --> ShortTerm[Short-term Investments]

CashActions --> DebtRepay[Early Debt Repayment]

CashActions --> InternalFund[Internal Funding of Subsidiaries]

ARMonitor --> End[End: Continuous Monitoring]

APMonitor --> End

InvMonitor --> End

CashMonitor --> End

ARDiscount --> End

ARTerms --> End

ARCollection --> End

APTerms --> End

APDiscount --> End

APSchedule --> End

JIT --> End

InvForecast --> End

InvConsign --> End

ShortTerm --> End

DebtRepay --> End

InternalFund --> EndProgram your Treasury Bot to implement these working capital optimization rules without requiring technical knowledge:

1. Accounts Receivable (AR) Optimization Rules

Create a set of logical rules in your spreadsheet for analyzing AR performance. For example:

IFDSO > Industry_Average + 5 THEN "Implement AR acceleration strategies"

IF Customer_X_Payment_Delay > 10 THEN "Flag for collections follow-up"

IF Cash_Forecast_Week1 < MinimumCashThreshold THEN "Consider factoring options for large receivables"

Practical Implementation:

- Set up conditional formatting to highlight problematic AR metrics

- Create an automated customer aging analysis that identifies payment pattern changes

- Implement standardized email templates for collection follow-ups that can be triggered by your automation tool

2. Accounts Payable (AP) Optimization Rules

Optimize your cash outflows with these decision rules. For example:

IF Supplier_Offers_Discount > (Annual_Borrowing_Rate/365*Discount_Days) THEN "Take early payment discount"

IF Cash_Position > OperatingCashNeeds + Buffer THEN "Consider early payments for discounts"

IF Cash_Position < OperatingCashNeeds THEN "Extend payments to maximum terms"Practical Implementation:

- Create a payment optimization calculator that weighs the cost of early payment discounts against the benefit

- Set up automated payment scheduling based on optimal payment dates

- Implement supplier segmentation based on criticality and negotiation leverage

3. Cash Deployment Optimization Rules

For idle cash management, implement these decision rules:

IFAverage_Daily_Balance_Account_X > NecessaryOperatingCash THEN "Transfer excess to investment account"

IF Investment_Option_A_Return > Investment_Option_B_Return AND Risk_Level_Acceptable THEN "Choose Investment Option A"

IF Subsidiary_X_Borrowing_Cost > Parent_Lending_Return THEN "Consider internal funding"

Practical Implementation:

- Create a threshold-based alert system for excess cash identification

- Build a simple investment option comparison tool

- Set up automated intercompany funding recommendations

Step 5: Setting Up Automated Alerts and Recommendations

The power of your Treasury Bot comes from its ability to notify you of critical situations and opportunities. Here’s how to set it up:

1. Define Your Alert Triggers

Use the alert configuration template above to define scenarios that require attention:

- Cash Position Alerts: Low cash, excess cash, upcoming large outflows

- Working Capital Alerts: DSO/DPO deviation, cash conversion cycle changes

- Risk Alerts: FX exposure, counterparty concentration, covenant breaches

- Opportunity Alerts: Investment options, early payment discount opportunities

2. Create Notification Templates

For each alert type, create standardized email templates with placeholders:

Subject: [ALERT] Cash Position Below Minimum Threshold

Body:

Dear Treasury Team,

The current cash position of $[CashPosition] is below the minimum threshold of $[MinimumThreshold].

Recommended actions:

1. Review upcoming outflows for possible deferrals

2. Accelerate collections from customers: [LateCustomerList]

3. Prepare to utilize standby credit facilities

Potential cash impact of actions: $[ImpactAmount]

This is an automated alert from your Treasury Bot.3. Set Up Delivery Mechanisms

Configure your automation platform to send alerts through different channels:

- Email: For detailed reports and recommendations

- Dashboard: For visual indicators visible at a glance

- Mobile App Notifications: If using Power BI or similar platform with mobile capabilities

4. Implement Escalation Protocols

For critical issues, create escalation rules:

IF Alert_Unacknowledged_After 2 Hours THEN Escalate_To Secondary_Contact

IF Cash_Position < Emergency_Threshold THEN Escalate_To CFO_ImmediatelyStep 6: Creating Your Working Capital Dashboard

Treasury Bot Working Capital Dashboard example:

Now that you have your Treasury Bot collecting data, analyzing working capital metrics, and generating alerts, it’s time to create a visual dashboard that makes this information actionable:

1. Select Your Dashboard Platform

Choose a business intelligence tool that’s accessible to non-technical users:

- Power BI: Microsoft’s powerful BI tool with Excel integration

- Tableau Public: Free version with robust visualization capabilities

- Google Data Studio: Free and easy to use with spreadsheet integration

2. Design Key Dashboard Elements

Your dashboard should include these critical components:

- Cash Position Summary: Current position, daily change, and 7-day trend

- Working Capital Metrics: DSO, DPO, DIO, and Cash Conversion Cycle with trend indicators

- Cash Flow Forecast: 13-day rolling forecast with threshold indicators

- Alert Panel: Active alerts requiring attention

- Optimization Opportunities: Actionable recommendations with quantified impact

3. Set Up Automated Refreshes

Configure your dashboard to update automatically:

- Scheduled Refreshes: Daily updates at set times (e.g., 9 AM)

- Data Connection: Link to your Excel template or database

- Distribution Settings: Automated email delivery of dashboard snapshots to stakeholders

Step 7: Implementing Complex Working Capital Scenarios

Let’s examine a complex scenario to demonstrate how your Treasury Bot would handle real-world challenges:

Scenario: Global Subsidiary with Multiple Currencies and Payment Terms

Challenge: Your company has subsidiaries in Europe, Asia, and North America. Each region has different payment terms, currencies, and banking relationships.

Bot Configuration:

- Multi-Currency Consolidation:

- Set up currency-specific worksheets in your template

- Create forex conversion tables that update daily via manual input from financial websites

- Implement a consolidated view that converts all positions to your base currency

- Regional Payment Pattern Analysis:

- Configure region-specific DSO/DPO targets based on local market practices

- Implement separate forecasting models for each region with appropriate seasonality factors

- Create normalized scoring to compare performance across regions

- Working Capital Optimization Rules:

- Set up inter-company netting opportunities to reduce cross-border transfers

- Implement region-specific internal lending rates based on local market conditions

- Create cash pooling recommendations for regions with shared currencies

Implementation Example: European Subsidiary Cash Optimization

European Cash Pooling Decision Rule:

IF EUR_Subsidiary_A_Cash > EUR_Minimum_Cash + EUR_Buffer AND

EUR_Subsidiary_B_Cash < EUR_Minimum_Cash AND

No_Regulatory_Restrictions_Between_A_B THEN

"Recommend cash transfer of [Optimal_Transfer_Amount] from Subsidiary A to B,

saving [External_Funding_Cost] in external financing costs"

WHERE Optimal_Transfer_Amount = MIN(

EUR_Subsidiary_A_Cash - (EUR_Minimum_Cash + EUR_Buffer),

EUR_Minimum_Cash - EUR_Subsidiary_B_Cash

)Step 8: Maintaining and Improving Your Treasury Bot

Your Treasury Bot will require ongoing maintenance and improvements:

1. Daily Operational Tasks

- Morning Data Refresh: Manually collect and input required data

- Exception Handling: Review and resolve any data validation errors

- Alert Review: Assess and act on generated alerts

2. Weekly Maintenance

- Forecast Accuracy Review: Compare actuals vs. forecast

- Rule Adjustment: Fine-tune thresholds based on business changes

- New Data Source Integration: Add any new relevant data sources

3. Monthly Improvement Cycle

- Working Capital Metric Review: Assess trends and effectiveness of actions

- Dashboard Enhancement: Add new visualizations based on stakeholder feedback

- Rule Enhancement: Add new optimization rules based on observed patterns

Conclusion: The Benefits of Your DIY Treasury Bot

By building your own Treasury Bot without coding or IT involvement, you’ll achieve:

- Centralized Visibility: Consolidated view of all cash positions and working capital metrics

- Proactive Management: Early identification of risks and opportunities

- Optimized Working Capital: Systematic improvements in DSO, DPO, and Cash Conversion Cycle

- Time Savings: Elimination of manual data collection and report creation

- Better Decision-Making: Data-driven insights for treasury actions

Most importantly, you’ll maintain control of your treasury processes while significantly enhancing their effectiveness – without dependence on IT resources or expensive specialized solutions.

Ready to get started? Use the templates and step-by-step guide above to build your Treasury Bot today. The initial setup may take 2-3 days, but the ongoing benefits will transform your treasury operations for years to come.

Disclaimer

This article provides a technical framework and demonstrates how to leverage existing tools to streamline treasury processes. The implementation described here assumes:

- Appropriate governance frameworks are already in place within your organization.

- Human oversight remains essential at critical approval points as detailed in the workflow.

- Organization-specific controls must be integrated based on your company’s policies and risk tolerance.

This guide focuses exclusively on the technical implementation aspects rather than governance, compliance, or accountability frameworks, which will vary by organization/ country/ region. Always consult with your compliance, security, finance, and legal teams to ensure the solution meets your organization’s specific requirements and standards before implementation.

Any automation solution should enhance—not replace—human judgment in financial processes. I don’t suggest full automation of processes, but rather the streamlining of workflows while maintaining appropriate controls.

Leave a Comment

You must be logged in to post a comment.