As a treasury professional, you’re constantly juggling cash flow management, risk analysis, investment decisions, and complex financial reporting. What if you could have a digital assistant that understands treasury operations and helps you perform daily tasks more efficiently—without requiring coding knowledge or IT department involvement?

This guide will walk you through creating your own Treasury AI Copilot using Microsoft Copilot, designed specifically for treasury operations. You’ll learn how to set it up, train it with your specific treasury knowledge, and deploy it to handle complex treasury scenarios.

What You’ll Need

- Microsoft 365 account with Copilot for Microsoft 365 access

- Your treasury documents, templates, and processes

- 2-3 hours for initial setup

Step 1: Setting Up Your Treasury Knowledge Hub

Before configuring your AI assistant, you need to organize your treasury knowledge. This will serve as the foundation for your Treasury Copilot.

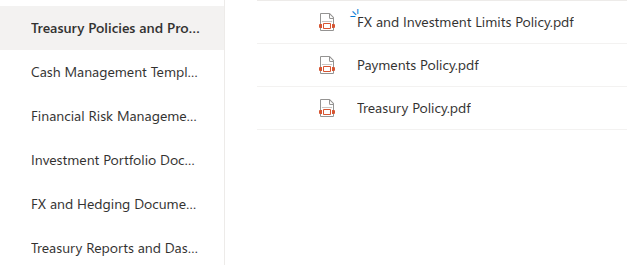

- Create a dedicated SharePoint site named for example “Treasury Knowledge Hub”

- Set up the following document libraries:

- Treasury Policies and Procedures

- Financial Risk Management Guidelines

- Cash Management Templates

- Investment Portfolio Documents

- FX and Hedging Documentation

- Treasury Reports and Dashboards

- Upload your key treasury documents to their respective libraries:

- Treasury policy documents

- Cash forecasting templates

- Risk management frameworks

- Bank relationship documentation

- Investment guidelines

- Hedging strategies

- Past treasury reports

Step 2: Enabling Your Microsoft Copilot

- Log into your Microsoft 365 account

- Access Microsoft Copilot through any of these methods:

- Visit copilot.microsoft.com

- Click the Copilot icon in Microsoft 365 apps (Word, Excel, PowerPoint, Outlook)

- Use Copilot in Microsoft Teams

- Connect your Treasury Knowledge Hub to Copilot:

- In Copilot, select “Add data sources”

- Choose your “Treasury Knowledge Hub” SharePoint site

- Confirm all document libraries are selected

- Click “Connect”

Step 3: Creating Your Treasury Copilot Prompt Library

This is where you’ll create specialized prompts for common treasury tasks. These will serve as quick shortcuts for your AI assistant.

- Create a new Excel workbook called “Treasury Copilot Prompts”

- Set up the following columns:

- Prompt Name

- Prompt Text

- Use Case

- Required Data Sources

- Add the following treasury-specific prompts:

Step 4: Training Your Treasury Copilot

Now it’s time to help your AI assistant understand your specific treasury operations and needs:

- Conduct an Initial Briefing Session Open Copilot and use this comprehensive prompt to establish context:

I work in the treasury department and need your help as my Treasury AI Copilot. You'll assist with cash management, risk analysis, financial reporting, investment decisions, debt management, and bank relationship management.

Our treasury operates with the following parameters:

- We manage approximately $[X] million in cash across [Y] bank accounts

- We have banking relationships with [BANK NAMES]

- Our main currencies are [LIST CURRENCIES]

- Our treasury policy requires [KEY POLICY POINTS]

- We use [TREASURY MANAGEMENT SYSTEM] for daily operations

- Key treasury challenges include [LIST CHALLENGES]

When assisting with treasury tasks, always consider:

1. Our risk management framework and treasury policy limits

2. Liquidity requirements for upcoming obligations

3. Counterparty exposure limits

4. Hedging strategies aligned with our policy

5. Reporting requirements and deadlines

Please confirm you understand these parameters and will operate as my Treasury AI Copilot.2. Upload Key Templates Upload your most frequently used treasury templates to Copilot, such as:

- Daily cash position template

- Cash forecast model

- FX exposure report

- Investment performance dashboard

- Bank relationship scorecard

For each template, explain to Copilot:

This is our [TEMPLATE NAME]. We use it for [PURPOSE]. Key components include [LIST IMPORTANT SECTIONS]. When working with this template, always ensure [CRITICAL REQUIREMENTS].

3. Create Treasury Scenarios for Training Present Copilot with common treasury scenarios to improve its understanding:

Let's walk through these treasury scenarios to improve your understanding:

Scenario 1: We need to make a $5M payment tomorrow, but our main operating account only has $3M. According to our treasury policy, what steps should we take?

Scenario 2: Our latest FX exposure report shows we're over-hedged in EUR/USD by €2M. How should we adjust our position?

Scenario 3: We have $10M in excess cash for 60 days. Given our investment guidelines, what investment options should we consider?Step 5: Setting Up Treasury Copilot Plugins

Microsoft Copilot can integrate with various plugins to enhance your treasury operations. Here’s how to set up the most useful ones:

- Excel Data Analysis Plugin

- In Copilot, click “Plugins”

- Enable “Excel”

- This allows your Treasury Copilot to analyze treasury data from Excel files

- Power BI Plugin

- Enable the “Power BI” plugin

- Connect to your treasury dashboards

- Now your Copilot can extract insights from treasury visualizations

- Financial Data Plugin

- Enable a financial data plugin if available

- This gives your Copilot access to market data (though not real-time)

- Calendar Plugin

- Enable the “Calendar” plugin

- Your Copilot can now help manage treasury deadlines and important dates

Step 6: Creating Treasury Copilot Workflows

Now, let’s set up workflows for complex treasury tasks that require multiple steps:

- Month-End Close Process Create this workflow in Copilot:

I need help with our treasury month-end close process. Please:

1. Generate a checklist based on our treasury procedures

2. Prepare the cash reconciliation template

3. Create a draft of the treasury report for management

4. Review bank covenant compliance status

5. Summarize investment performance for the month

6. Generate an FX gain/loss report

7. Identify any exceptions or issues requiring attention2. Cash Forecasting Workflow

Help me update our 13-week cash forecast. Please:

1. Review our latest A/R aging report to estimate collections

2. Incorporate known major payments from our A/P schedule

3. Include scheduled debt payments from our debt schedule

4. Add planned investment maturities

5. Calculate weekly net cash positions

6. Identify any weeks with potential cash shortfalls

7. Suggest liquidity management actions according to our policy3. Risk Analysis Workflow

Conduct a treasury risk assessment based on our current positions. Please:

1. Review our liquidity risk based on cash positions vs. requirements

2. Analyze counterparty risk across our banking relationships

3. Assess FX risk from our latest exposure report

4. Evaluate interest rate risk in our debt portfolio

5. Review investment portfolio risks

6. Identify our top 3 treasury risks

7. Recommend mitigating actions aligned with our policyStep 7: Real-World Use Cases for Your Treasury Copilot

Let’s explore complex real-world scenarios where your Treasury Copilot can provide significant value:

Use Case 1: Managing a Liquidity Crisis

Imagine you receive unexpected news that a major customer payment of $7.5M will be delayed by two weeks, creating a potential cash shortfall for an upcoming $5M debt payment.

You can prompt your Treasury Copilot:

We just learned that [CUSTOMER] payment of $7.5M will be delayed until [DATE], creating a potential cash shortfall for our $5M debt payment due on [DATE]. Based on our treasury policy and current cash positions, help me:

1. Assess the impact on our cash position

2. Identify potential internal sources of liquidity

3. Evaluate short-term funding options allowed by our policy

4. Draft communication for stakeholders

5. Create an action plan with timeline

Use Case 2: Navigating Currency Volatility

Your company has significant exposure to a currency experiencing high volatility due to geopolitical events.

Prompt your Treasury Copilot:

We're facing significant volatility in [CURRENCY] due to [EVENT]. Our current exposure is [AMOUNT] with [HEDGING DETAILS]. Based on our risk management framework:

1. Analyze the potential impact on our financial statements

2. Evaluate our current hedging strategy effectiveness

3. Suggest adjustments to our hedging approach within policy limits

4. Create scenarios showing financial impacts of different hedging strategies

5. Draft a briefing for the CFO explaining our recommended approachUse Case 3: Optimizing Banking Relationships

Your company is considering consolidating banking relationships to improve efficiency and reduce costs.

Prompt your Treasury Copilot:

We're evaluating our banking relationships with [BANK A], [BANK B], and [BANK C]. Help me:

1. Analyze services, fees, and credit facilities from each bank

2. Create a comparison matrix of key banking services we use

3. Identify potential efficiency gains from consolidation

4. Calculate potential cost savings

5. Develop a bank relationship optimization strategy

6. Draft a transition plan that minimizes operational disruptionUse Case 4: Revising Treasury Policy

You need to update your treasury policy to address new business requirements and market conditions.

Prompt your Treasury Copilot:

Our treasury policy needs updating to address [NEW BUSINESS REQUIREMENTS] and [MARKET CONDITIONS]. Please:

1. Review our current policy and identify sections requiring updates

2. Suggest specific revisions to our investment guidelines

3. Recommend updates to our risk management framework

4. Propose new counterparty limits based on current credit ratings

5. Update our liquidity management requirements

6. Draft the revised policy sections with tracked changes

7. Create an executive summary explaining key changes and rationaleStep 8: Maintaining and Improving Your Treasury Copilot

To ensure your Treasury Copilot continues to provide value:

- Regular Knowledge Updates

- Update your Treasury Knowledge Hub with new policies, procedures, and templates

- After major changes, brief your Copilot on the updates

- Feedback Loop

- Note when Copilot provides especially useful insights

- Document areas where it could improve

- Use these insights to refine your prompts

- Expand Use Cases

- Gradually introduce your Copilot to more complex treasury scenarios

- Add specialized workflows for quarterly and annual treasury processes

- Best Practices

- Always review Copilot outputs for accuracy

- Maintain confidentiality by not sharing sensitive financial data if not allowed.

- Document successful Copilot workflows for team knowledge sharing

Conclusion

By following this guide, you’ve created a powerful Treasury AI Copilot that understands your specific treasury operations, policies, and challenges. This assistant will help you perform daily treasury tasks more efficiently, analyze complex financial scenarios, and generate insights that enhance decision-making—all without requiring technical expertise or IT department resources.

As you continue working with your Treasury Copilot, you’ll discover new ways it can support your treasury operations, saving time and improving the strategic value of your treasury function.

Remember that your Treasury Copilot is only as good as the knowledge you provide it. Keep your treasury documentation updated, refine your prompts based on experience, and continuously look for new ways to leverage this powerful tool in your treasury operations.

Disclaimer

This article provides a technical framework and demonstrates how to leverage existing tools to streamline treasury processes. The implementation described here assumes:

- Appropriate governance frameworks are already in place within your organization.

- Human oversight remains essential at critical approval points as detailed in the workflow.

- Organization-specific controls must be integrated based on your company’s policies and risk tolerance.

This guide focuses exclusively on the technical implementation aspects rather than governance, compliance, or accountability frameworks, which will vary by organization/ country/ region. Always consult with your compliance, security, finance, and legal teams to ensure the solution meets your organization’s specific requirements and standards before implementation.

Any automation solution should enhance—not replace—human judgment in financial processes. I don’t suggest full automation of processes, but rather the streamlining of workflows while maintaining appropriate controls.

Leave a Comment

You must be logged in to post a comment.