In treasury, tracking investments efficiently is crucial but often involves manual work in Excel or outdated systems. This guide shows you step-by-step how to create a Treasury Bot for investment tracking—without coding or IT support—using Power Automate, Excel Online, Microsoft Teams, and Power BI for real-time analytics, integrating features from a Treasury Management System (TMS).

Tools You’ll Need

- Microsoft Power Automate: A no-code automation tool that connects apps and services.

- Microsoft Excel/Google Sheets: For data management.

- Microsoft Power BI: For data visualization and reporting.

Step 1: Define Your Investment Tracking Needs

Before automating, list what you need to track:

- Investment types (bonds, deposits, MMFs, FX deals, derivatives, structured products, etc.)

- Maturity dates

- Interest rates and yields

- Counterparties

- Cash flows (inflows/outflows)

- Market benchmarks and deviation tracking

- Risk exposure and hedging status

- Settlement Instructions and counterparties’ payment preferences

- Compounded interest rate tools (Lookback, Lag days, Spread adjustments)

Your goal is to ensure the bot provides dynamic real-time tracking, risk alerts, and comprehensive reports.

Step 2: Setting Up Your Data Source

Organize your investment data in an Excel or Google Sheets spreadsheet. This should include:

| Investment Type | Amount | Interest Rate | Start Date | Maturity Date | Settlement Instructions |

|---|---|---|---|---|---|

| Money Market | 10,000 | 3% | 01/01/2025 | 01/02/2025 | Bank Transfer |

This file will be the core of your bot, automatically updated with market rates and new deals.

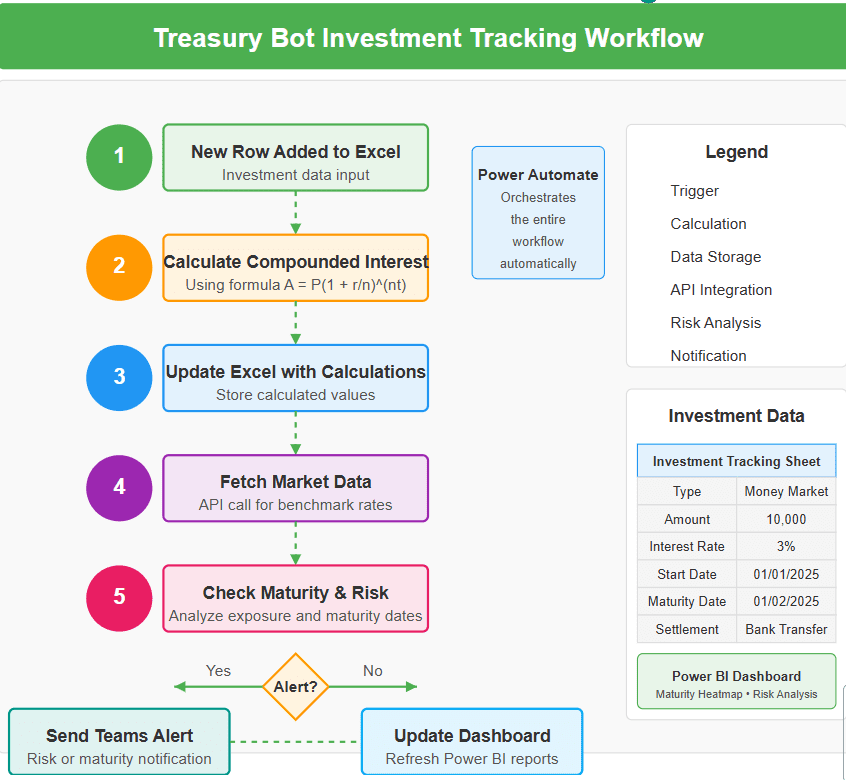

Step 3: Automate Investment Tracking with Power Automate

1. Creating the Bot with Microsoft Power Automate

- Sign in to Power Automate and go to “Create”.

- Choose Automated Flow.

2. Set Up Triggers and Actions

- Trigger: “When a new row is added to Excel” (or Google Sheets).

- Action 1: Calculate compounded interest using predefined formulas.

- Action 2: Update Excel with calculated values.

- Action 3: Send a notification email.

3. Fetch Market Data for Comparison

- Integrate an API like Alpha Vantage or Bloomberg Data Feed using the HTTP Request action in Power Automate and create a step. If not available, you may skip this step and you’ll need to manually feed with market data.

- Compare investment rates against market rates using the “Condition” action.

- If a deviation exceeds a set threshold (e.g., 0.5%), trigger an alert.

4. Incorporating Compounded Interest Rate Calculations

- Formula: Use Excel’s formula to calculate compounded interest.Formula: A = P(1 + r/n)^(nt)Where:

- A = amount of money accumulated

- P = principal amount

- r = annual interest rate

- n = number of times interest applied per time period

- t = time periods elapsed

- Automation: Use Power Automate to automate these calculations whenever new data is added.

5. Risk Exposure Alerts & Hedging Suggestions

- Implement “Condition” actions to check if exposure exceeds a predefined limit.

- If exceeded, trigger a Teams Message with recommended hedging actions.

- Example: “FX Exposure on EUR/USD exceeds 5M. Consider a forward contract hedge.”

6. Managing Deal Rollovers

- Rollover Logic: Define criteria for deal rollovers (e.g., maturity dates).

- Automate Rollovers: Use Power Automate to trigger actions for deal rollovers.

- Set conditions based on maturity dates.

- Update records and notify relevant parties.

7. Handling Settlement Instructions

- Define Instructions: Clearly define settlement instructions in your data source (Excel)

- Automate Settlements: Use Power Automate to concatenate SSI and your database, generate an XML file with payments for maturing deal.

- Example Flow:

- Trigger: Maturity date reached.

- Action 1: Extract settlement data from Excel.

- Action 2: Extract maturing deals from database.

- Action 3: Generate XML

- Action 4: Notify treasury team and send the payment file.

8. Send Alerts in Microsoft Teams and Email

- Add the “Post message in a chat or channel” action for Teams.

- Choose your Treasury team/channel.

- Write a message like: “Reminder: The following investments are maturing soon: [list of deals]. Review hedging strategy as needed.”

- Alternatively, use the “Send an email (Outlook)” action for email notifications.

Step 4: Automate Advanced Investment Reports in Power BI

To create real-time dashboards:

- Use the “Refresh a dataset” action in Power Automate to trigger Power BI updates.

- Design Power BI visuals:

- Investment Maturity Heatmap

- Market Rate vs. Investment Rate Comparison

- Exposure Risk Dashboard

- Compounded Interest Rate Analysis Panel

- Embed reports in Microsoft Teams for easy access.

Step 5: Enable User-Friendly Investment Updates

To allow non-technical users to update investments:

- Use Microsoft Forms for easy data entry.

- Create a Power Automate Flow that adds form responses to Excel automatically.

- Add a PowerApps Interface for direct data input and analytics access.

- Enable Deal Rollovers and Settlement Instruction Customization through interactive PowerApps components.

Results & Benefits

✅ No more manual tracking – The bot ensures real-time updates. ✅ Market-aware decisions – Compare against benchmarks instantly. ✅ Proactive risk management – Alerts and hedging suggestions. ✅ Custom settlement instructions – Automate SSI updates based on counterparties. ✅ Compounded interest calculations – Precision in investment profitability. ✅ No IT required – You control the process within Treasury. ✅ Seamless reporting – Automated Power BI dashboards keep management informed.

This Treasury Bot goes beyond simple tracking—it enhances investment decision-making with automation and analytics, incorporating TMS functionalities like compounded interest tools, deal rollovers, and settlement management. Try it and elevate your treasury operations today!

Leave a Comment

You must be logged in to post a comment.