Introduction

Cash flow forecasting is a cornerstone of financial planning, enabling organizations to predict their future cash positions and make informed decisions about liquidity management, investments, and debt servicing. Accurate forecasts ensure that a business can meet its short-term obligations while optimizing the use of surplus cash. This chapter introduces the fundamentals of cash flow forecasting, its importance, methodologies, and challenges.

- What is Cash Flow Forecasting?

1.1 Definition

Cash flow forecasting is the process of estimating the inflows and outflows of cash over a specific period. It helps organizations understand their liquidity position and plan for future financial requirements.

1.2 Time Horizons

- Short-Term Forecasting:

- Focuses on immediate liquidity needs (daily, weekly, or monthly).

- Used for operational planning and treasury management.

- Medium-Term Forecasting:

- Covers a few months to a year.

- Balances operational and strategic cash flow requirements.

- Long-Term Forecasting:

- Extends beyond a year, focusing on strategic objectives like investments or debt restructuring.

- Why is Cash Flow Forecasting Important?

2.1 Ensuring Liquidity

- Prevents cash shortages that could disrupt operations or result in penalties.

- Helps maintain optimal cash reserves.

2.2 Supporting Decision-Making

- Guides investment decisions, debt repayment schedules, and dividend policies.

- Provides insights for managing working capital effectively.

2.3 Managing Risks

- Identifies potential cash flow gaps or surpluses early, enabling proactive responses.

- Mitigates risks from market volatility, seasonal fluctuations, or unforeseen expenses.

2.4 Enhancing Stakeholder Confidence

- Demonstrates financial stability and foresight to investors, lenders, and stakeholders.

- Key Components of a Cash Flow Forecast

3.1 Cash Inflows

- Operating Activities:

- Customer payments.

- Receipts from accounts receivable.

- Investing Activities:

- Proceeds from asset sales.

- Dividends and interest income.

- Financing Activities:

- Loan proceeds.

- Issuance of equity.

3.2 Cash Outflows

- Operating Activities:

- Supplier payments.

- Payroll and operating expenses.

- Investing Activities:

- Purchases of assets or capital expenditures.

- Financing Activities:

- Debt repayments.

- Dividend payouts.

3.3 Opening and Closing Balances

- Calculate the net cash flow to determine the closing balance for a given period.

- Methodologies in Cash Flow Forecasting

4.1 Direct Method

- Tracks actual cash inflows and outflows on a granular level.

- Best Suited For:

- Short-term forecasts.

- Treasury and operational planning.

- Advantages:

- High accuracy for short periods.

- Easy to understand and implement.

4.2 Indirect Method

- Adjusts net income for non-cash transactions and changes in working capital.

- Best Suited For:

- Medium to long-term forecasting.

- Strategic planning.

- Advantages:

- Links cash flow to broader financial statements.

- Provides insights into the financial health of the organization.

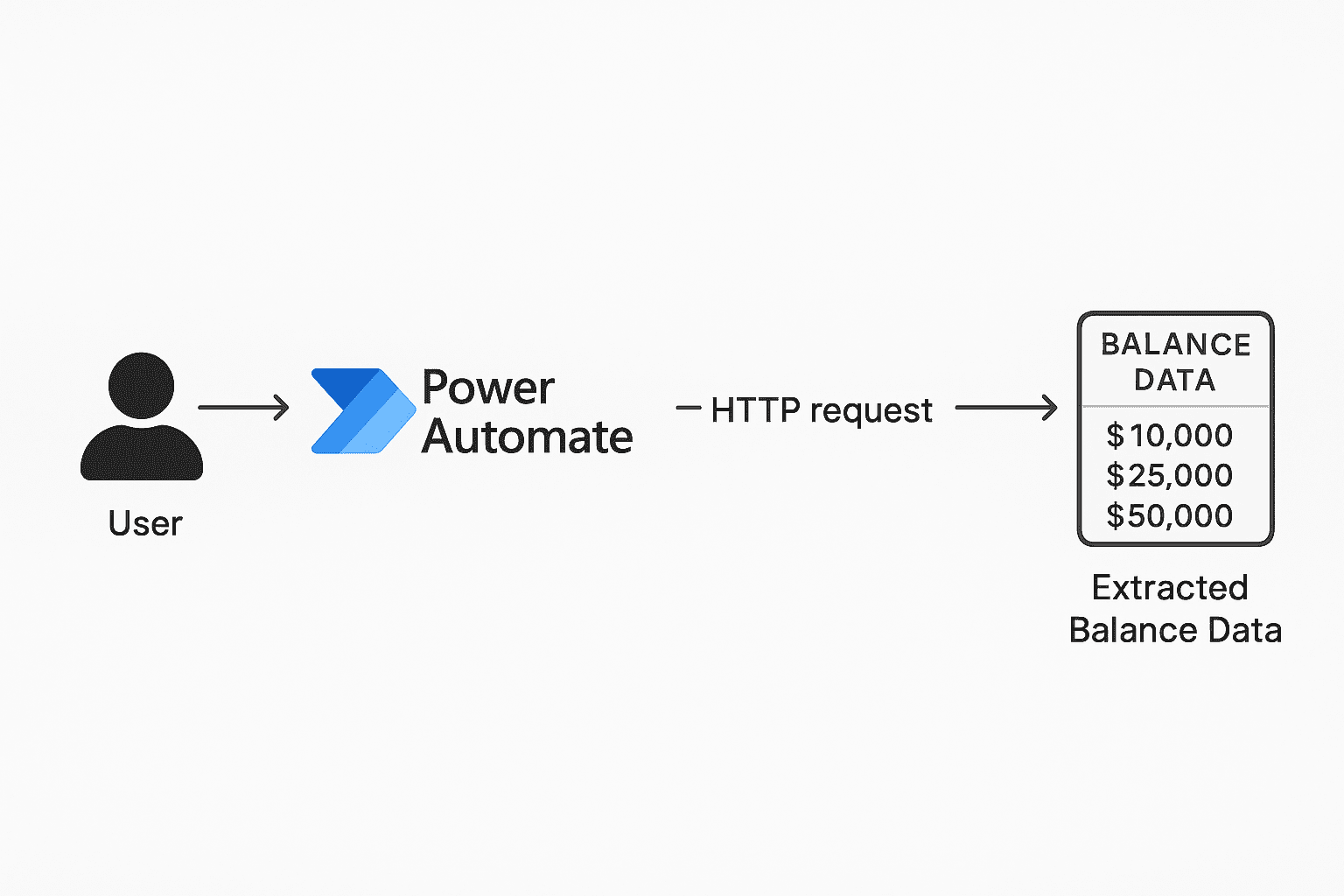

- Tools and Technologies for Cash Flow Forecasting

5.1 Spreadsheet Models

- Excel or Google Sheets are widely used for manual forecasting.

- Advantages:

- Flexibility and customization.

- Low cost.

- Challenges:

- Prone to errors.

- Time-consuming for complex forecasts.

5.2 Treasury Management Systems (TMS)

- Automates data collection and forecast generation.

- Examples: Kyriba, SAP Treasury, FIS Quantum.

- Advantages:

- Real-time updates.

- Integration with ERP and accounting systems.

5.3 Predictive Analytics Tools

- Leverage AI and machine learning to enhance accuracy.

- Examples:

- Cashforce, Planful, Adaptive Insights.

- Advantages:

- Identifies trends and patterns.

- Adapts to changing market conditions.

5.4 Cloud-Based Platforms

- Enable collaborative forecasting across departments.

- Provide real-time visibility into cash positions.

- Challenges in Cash Flow Forecasting

6.1 Data Quality and Availability

- Incomplete or inaccurate data can skew forecasts.

- Solution: Use integrated systems to ensure real-time, accurate data capture.

6.2 Volatility and Uncertainty

- External factors like market conditions, geopolitical events, or economic downturns can disrupt forecasts.

- Solution: Incorporate scenario planning and stress testing.

6.3 Coordination Across Departments

- Lack of communication between finance, sales, and operations can lead to inconsistent data.

- Solution: Foster collaboration and align forecasts with organizational goals.

6.4 Over-Reliance on Historical Data

- Past trends may not always predict future cash flows accurately.

- Solution: Combine historical analysis with real-time data and predictive tools.

- Best Practices for Cash Flow Forecasting

- Define Clear Objectives:

- Establish what the forecast aims to achieve (e.g., liquidity management, risk mitigation).

- Update Regularly:

- Refresh forecasts frequently to reflect current conditions.

- Use Scenario Analysis:

- Model best-case, worst-case, and baseline scenarios to prepare for uncertainties.

- Involve Stakeholders:

- Collaborate with all relevant departments for comprehensive data collection.

- Leverage Technology:

- Adopt tools that enhance accuracy, reduce errors, and save time.

- The Future of Cash Flow Forecasting

8.1 Integration with AI and Machine Learning

- Predictive models will become increasingly accurate with AI-driven insights.

- Real-time adjustments based on market data will enhance forecast reliability.

8.2 Blockchain and Real-Time Data Sharing

- Blockchain technology could facilitate secure and transparent data sharing across departments and external stakeholders.

8.3 Increased Focus on ESG and Sustainability

- Future forecasts may incorporate ESG metrics to align with sustainability goals and regulatory requirements.

Conclusion

Cash flow forecasting is a vital tool for businesses, providing the insights needed to navigate complex financial landscapes. By understanding the fundamentals and leveraging modern methodologies and technologies, organizations can ensure liquidity, manage risks, and make informed decisions. This introduction sets the stage for exploring advanced forecasting techniques, tools, and real-world applications in subsequent chapters.

Leave a Comment

You must be logged in to post a comment.