Introduction

Capital markets play a pivotal role in modern finance, serving as platforms for raising funds and allocating capital efficiently. Managing investments in capital markets involves strategic planning, risk assessment, and active monitoring to optimize returns and achieve financial objectives. This chapter provides a comprehensive guide to understanding capital market investments, key instruments, strategies for managing them, and tools for ensuring their success.

- Overview of Capital Market Investments

1.1 Definition

Capital markets are financial platforms where long-term securities, such as stocks and bonds, are issued and traded.

Example: New York Stock Exchange (NYSE) and NASDAQ are capital markets for equities.

1.2 Key Characteristics

Long-Term Nature

Securities are typically held for extended periods to achieve capital appreciation or income generation.

Example: Investing in corporate bonds with a 10-year maturity.

Liquidity

Capital markets provide liquidity for investors to buy or sell securities.

Example: Selling shares in a blue-chip company with high trading volumes.

Diverse Participants

Includes individual investors, institutional investors, issuers (corporations/governments), and intermediaries (banks, brokers).

- Types of Capital Market Investments

2.1 Equity Investments

Common Stocks

Represent ownership in a company with potential for dividends and capital gains.

Example: Buying shares in Tesla for long-term growth potential.

Preferred Stocks

Offer fixed dividends and priority over common stock in case of liquidation.

Example: Preferred shares in utilities companies for steady income.

Exchange-Traded Funds (ETFs)

Pooled investments that track market indices or sectors.

Example: SPDR S&P 500 ETF (SPY).

2.2 Debt Investments

Corporate Bonds

Issued by corporations to finance operations, offering fixed or variable interest.

Example: Investing in Apple Inc.’s 10-year bonds with a 3% coupon rate.

Government Bonds

Issued by national or local governments for public projects or debt financing.

Example: U.S. Treasury Bonds and UK Gilts.

Municipal Bonds

Bonds issued by local governments with tax-exempt benefits.

Example: A municipal bond funding a new public school project.

2.3 Hybrid Instruments

Convertible Bonds

Bonds that can be converted into equity at a predetermined rate.

Example: A convertible bond issued by a technology startup.

Perpetual Bonds

Bonds with no maturity date, offering indefinite interest payments.

Example: Perpetual bonds issued by financial institutions.

2.4 Derivatives

Stock Options

Contracts providing the right (but not obligation) to buy or sell a stock at a set price.

Example: Call and put options on Amazon stock.

Futures Contracts

Agreements to buy or sell an asset at a predetermined price on a future date.

Example: S&P 500 futures for portfolio hedging.

- Strategies for Managing Capital Market Investments

3.1 Portfolio Diversification

Spread investments across asset classes, sectors, and geographies to minimize risks.

Example: Allocating 50% to equities, 30% to bonds, and 20% to alternative assets.

3.2 Active vs. Passive Management

Active Management

Frequent buying and selling to outperform the market.

Example: A fund manager selects stocks expected to outperform.

Passive Management

Mimicking the performance of market indices through ETFs or index funds.

Example: Investing in a fund tracking the S&P 500.

3.3 Risk Management

Market Risk

Mitigate volatility through hedging or asset allocation.

Example: Use options to protect against stock market downturns.

Credit Risk

Assess creditworthiness of bond issuers.

Example: Invest in investment-grade bonds rated BBB or higher.

Liquidity Risk

Invest in securities with high trading volumes.

Example: Focus on large-cap stocks.

3.4 Time Horizon and Goal Alignment

Match investments with financial objectives and timelines.

Example: Use bonds for retirement income and equities for long-term growth.

3.5 Monitoring and Rebalancing

Regularly review portfolios and adjust allocations based on market conditions.

Example: Rebalance a portfolio annually to maintain a 60/40 equity-to-bond ratio.

- Tools and Technologies for Managing Investments

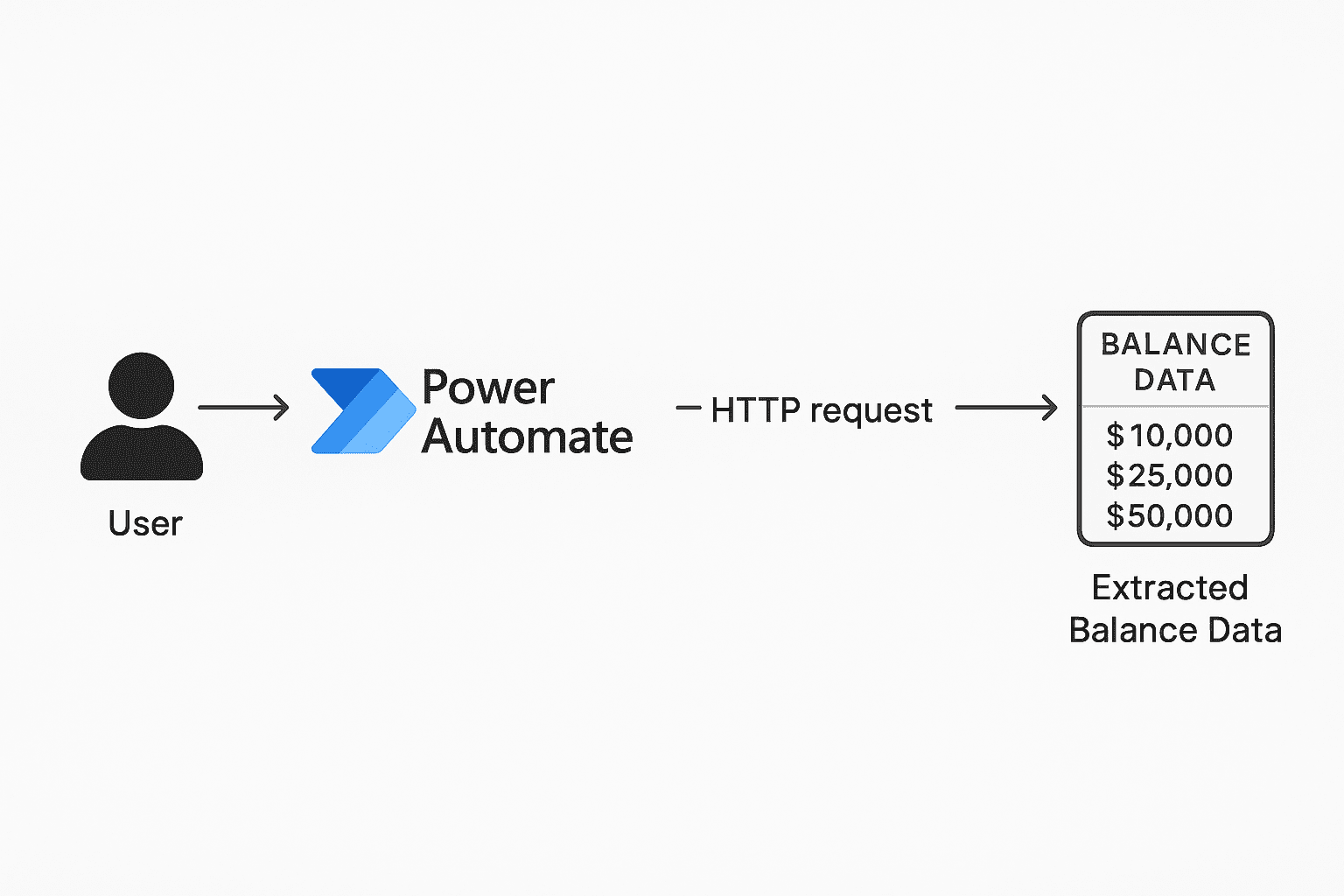

4.1 Portfolio Management Software

Tools for tracking performance, assessing risk, and optimizing allocation.

Example: Morningstar Direct or Bloomberg Terminal.

4.2 Robo-Advisors

Automated platforms offering algorithm-driven investment strategies.

Example: Betterment or Wealthfront.

4.3 Risk Analytics Tools

Use advanced analytics to assess and model portfolio risks.

Example: Monte Carlo simulations for stress testing.

4.4 Real-Time Data Platforms

Access market data for informed decision-making.

Example: Reuters or Yahoo Finance.

- Benefits of Capital Market Investments

Capital Growth

Potential for significant returns through capital appreciation.

Example: A technology stock doubling in value over five years.

Income Generation

Regular income from dividends or interest payments.

Example: Quarterly dividends from a utility stock.

Liquidity

Easy access to funds through active secondary markets.

Example: Selling shares in a major stock exchange.

Portfolio Diversification

Access to a wide range of asset classes and sectors.

Example: Diversifying across tech, healthcare, and energy sectors.

Hedge Against Inflation

Certain assets, such as equities, can outpace inflation over time.

Example: Long-term equity investments maintaining purchasing power.

- Risks of Capital Market Investments

Market Volatility

Rapid price fluctuations can lead to short-term losses.

Example: Stock market declines during economic downturns.

Interest Rate Risk

Rising interest rates reduce bond prices.

Example: A 10-year bond losing value during a rate hike cycle.

Credit Risk

Possibility of issuer default on debt obligations.

Example: A corporate bond issuer filing for bankruptcy.

Regulatory and Political Risks

Changes in regulations or geopolitical events impacting markets.

Example: Trade tensions affecting export-driven stocks.

Currency Risk

Exchange rate fluctuations affecting international investments.

Example: Depreciation of the Euro impacting a U.S. investor’s European holdings.

- Case Study: Managing a Balanced Capital Market Portfolio

Scenario:

An individual investor aims to build a balanced portfolio for long-term growth and stability.

Portfolio Allocation:

50% equities: Blue-chip stocks, ETFs, and growth stocks.

40% bonds: U.S. Treasury bonds and investment-grade corporate bonds.

10% alternatives: REITs and commodities.

Strategies Used:

Regular rebalancing to maintain the 50/40/10 allocation.

Use of dividend-paying stocks for income generation.

Hedging equity positions with options during periods of high market volatility.

Outcome:

Achieved an annualized return of 8%.

Minimized losses during market downturns through effective diversification and hedging.

Conclusion

Managing capital market investments requires a strategic approach, balancing growth, income, and risk mitigation. By leveraging diversification, active monitoring, and advanced tools, investors can optimize their portfolios for long-term success.

Leave a Comment

You must be logged in to post a comment.