What is MCNP and Why Should You Care?

Imagine having a virtual treasury command center where all your global cash positions speak to each other instantly, without moving a single dollar physically. That’s exactly what Multi-Currency Notional Pooling (MCNP) delivers.

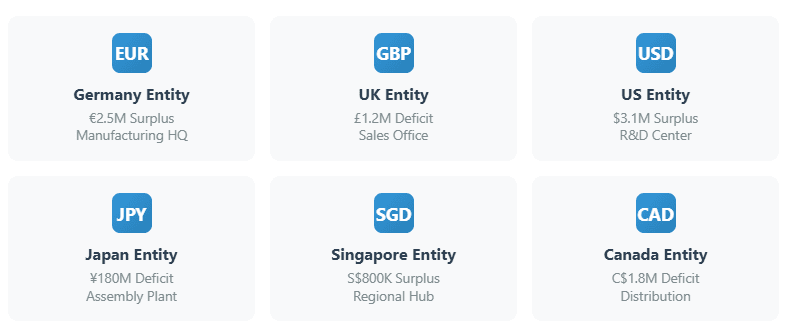

Think of MCNP as a sophisticated financial calculator that operates 24/7. Instead of having €2M sitting idle in Germany while your UK subsidiary desperately needs £1.5M and pays overdraft fees, MCNP mathematically offsets these positions. Your German surplus virtually covers the UK deficit without any physical money movement or foreign exchange transactions.

But let’s be clear: It’s not magic. It’s advanced banking mathematics with real costs and limitations.

The Risk Management Game-Changer

Traditional treasury management is like playing chess blindfolded. You know you have pieces (cash) scattered across the board (global accounts), but you can’t see the full picture. MCNP removes the blindfold.

The Real Benefits:

Liquidity Risk Reduction: Instead of maintaining safety buffers in each country (expensive insurance), you create one intelligent buffer that serves all entities. But this concentration also creates new risks.

FX Exposure Management: Every intercompany loan traditionally creates FX risk requiring hedging. With MCNP, many of these exposures can offset each other. When your Swiss subsidiary draws CHF against your pool while you have EUR surplus, you’re naturally hedging existing positions rather than creating new ones.

Interest Rate Optimization: Banks offer better pricing for pooled positions because they reduce their own regulatory capital requirements. This isn’t charity—it’s risk mathematics. When your positions offset, the bank’s risk decreases, and they share some of these savings with you.

The Real Challenges:

Bank Dependency: Your entire cash optimization becomes dependent on one banking relationship. If that bank has system issues, regulatory problems, or changes pricing, you’re exposed.

Regulatory Complexity: Different countries have different rules about notional pooling. What works in Germany might be restricted in Brazil or India. These restrictions change, and you need to stay compliant.

Implementation Reality: Despite what vendors claim, MCNP implementations often take 6-12 months and require some IT resources. System integrations fail, data quality issues emerge, and staff need extensive training.

When MCNP Makes Sense (And When It Doesn’t)

MCNP is Right For You If:

- You have cash balances >€50M across multiple currencies

- Significant idle cash sits alongside overdraft usage

- Strong treasury team with system integration capabilities

- Stable banking relationships in key markets

- Regulatory environment supports notional pooling structures

Skip MCNP If:

- Total cash balances <€20M (costs likely exceed benefits)

- Heavy regulatory restrictions in key markets

- Weak IT infrastructure or limited treasury resources

- Frequent M&A activity (constant restructuring disrupts optimization)

- Banking relationships are unstable or fragmented

Mathematical Explanation

Core Concept

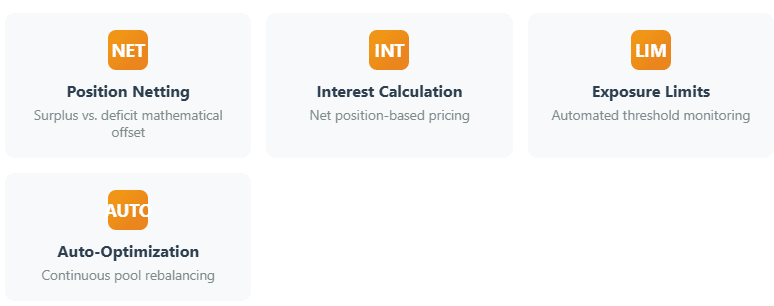

We know multi-currency notional pooling allows companies to offset positive and negative balances across different currencies without physically moving funds. And the interest is calculated on the net position after converting all balances to a base currency.

But let’s calculate the whole process.

Step-by-Step Mathematical Process

| Step | Description | Mathematical Formula | Example Calculation |

|---|---|---|---|

| 1. Individual Account Balances | Record actual balances in each subsidiary account | Balance₍ᵢ₎ in Currency₍ᵢ₎ | Account A (USD): $500,000<br>Account B (EUR): €-300,000<br>Account C (GBP): £200,000 |

| 2. Exchange Rate Conversion | Convert all balances to base currency using spot rates | Base Balance₍ᵢ₎ = Balance₍ᵢ₎ × FX Rate₍ᵢ₎ | USD/USD: $500,000 × 1.00 = $500,000<br>EUR/USD: €-300,000 × 1.10 = $-330,000<br>GBP/USD: £200,000 × 1.25 = $250,000 |

| 3. Net Pool Position | Sum all converted balances to find net exposure | Net Position = Σ Base Balance₍ᵢ₎ | Net Position = $500,000 + (-$330,000) + $250,000 = $420,000 |

| 4. Interest Calculation | Apply interest rate only to net position | Interest = Net Position × Rate × (Days/360) | Assuming 2.5% rate for 30 days:<br>Interest = $420,000 × 0.025 × (30/360) = $875 |

| 5. Interest Allocation | Distribute interest back to accounts based on contribution | Allocation₍ᵢ₎ = (Base Balance₍ᵢ₎/Net Position) × Total Interest | Account A: ($500,000/$420,000) × $875 = $1,042<br>Account B: (-$330,000/$420,000) × $875 = -$688<br>Account C: ($250,000/$420,000) × $875 = $521 |

Benefit Analysis

Without Notional Pooling

| Account | Balance | Interest Rate | Days | Interest Earned/Paid |

|---|---|---|---|---|

| Account A (USD) | $500,000 | +2.5% | 30 | +$1,042 |

| Account B (EUR) | €-300,000 | -4.0% | 30 | -€1,000 = -$1,100 |

| Account C (GBP) | £200,000 | +1.8% | 30 | +£300 = +$375 |

| Net Cost | -$317 |

With Notional Pooling

| Pool Net Position | Interest Rate | Days | Total Interest |

|---|---|---|---|

| $420,000 | +2.5% | 30 | +$875 |

Savings = $875 – (-$317) = $1,192 per month

Key Mathematical Relationships

FX Risk Mitigation

Unhedged Exposure = Σ|Balance₍ᵢ₎ × FX Rate₍ᵢ₎|

Hedged Exposure = |Σ(Balance₍ᵢ₎ × FX Rate₍ᵢ₎)|

Risk Reduction = Unhedged Exposure - Hedged Exposure

Example:

- Unhedged: |$500,000| + |-$330,000| + |$250,000| = $1,080,000

- Hedged: |$500,000 + (-$330,000) + $250,000| = $420,000

- Risk Reduction: $660,000 (61% decrease)

Optimal Pool Composition

For maximum efficiency, aim for:

Σ(Positive Balances) ≈ Σ(Negative Balances)

This minimizes the net position and maximizes netting benefits.

Daily Rebalancing Example

| Day | USD Account | EUR Account (USD equiv) | GBP Account (USD equiv) | Net Position | Daily Interest |

|---|---|---|---|---|---|

| Day 1 | $500,000 | -$330,000 | $250,000 | $420,000 | $29.17 |

| Day 2 | $480,000 | -$340,000 | $260,000 | $400,000 | $27.78 |

| Day 3 | $520,000 | -$325,000 | $245,000 | $440,000 | $30.56 |

Monthly Total: $875 (sum of daily calculations)

This structure eliminates the need for physical fund transfers while optimizing interest costs across the entire corporate treasury.

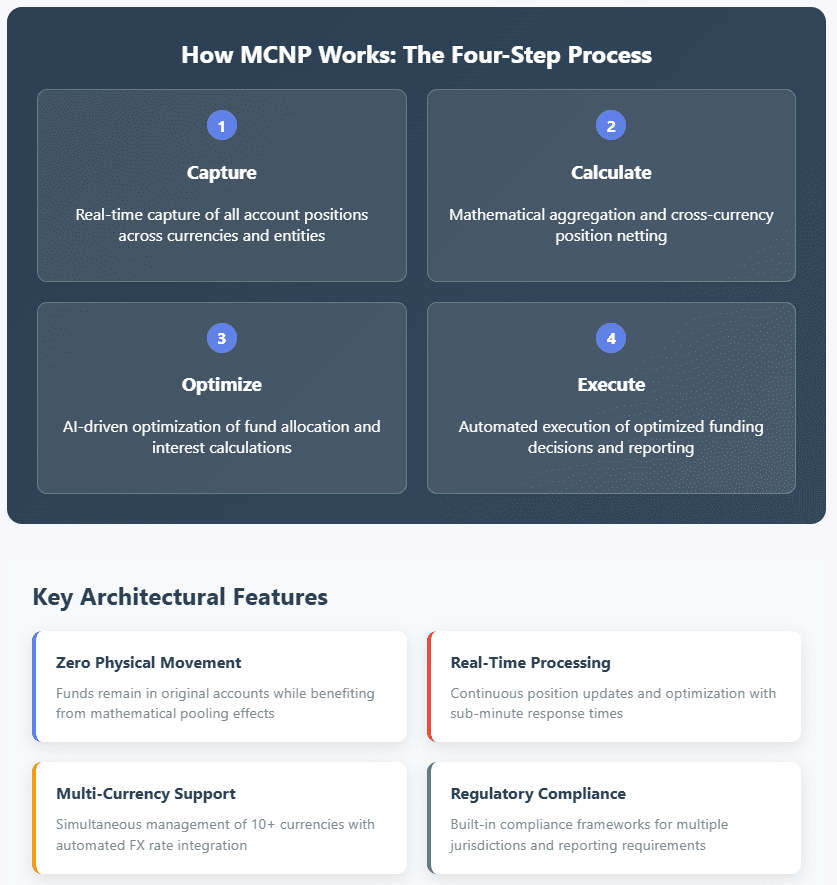

Technology Implementation: The Real Roadmap

Phase 1: Banking Platform Selection (Weeks 1-8, not 4)

Your technology journey starts with choosing the right banking partner. Not all banks offer true MCNP—many provide basic cash concentration that requires physical sweeps.

Critical Requirements:

- Real-time position aggregation across your specific currencies

- Automated interest calculation on net positions

- Integrated reporting for all your jurisdictions

- Proven connectivity for your ERP systems

Reality Check: Expect 3-6 months for complex multi-bank implementations. Banks promise “seamless integration” but rarely deliver on initial timelines.

Phase 2: ERP Integration Setup (Weeks 9-20)

This is where non-technical treasurers often encounter unexpected complexity. While integration modules exist, they still require configuration and testing.

Your Practical Approach:

- Bank Connectivity Module: Most ERPs (SAP, Oracle, NetSuite) and TMSs have pre-built modules.

- Automated Data Feeds: Set up daily imports of pool positions, interest charges, and FX rates.

- Cash Positioning Dashboard: Build in your ERP, TMS, or use bank’s online platform. Each has trade-offs in functionality and cost. Or use Excel.

Technology Requirement: Insist on straight-through processing, but budget for some manual intervention during the first 6 months.

Phase 3: Monitoring and Control Systems (Weeks 21-30)

Deploy treasury management systems (TMS) that integrate with your MCNP structure:

- Reconciliation: Automated bank statement import and matching

- Forecasting Integration: Connect cash flow forecasts to pool optimization

- Exception Reporting: Alert systems for limit breaches and system failures

Business Case: The Numbers That Actually Matter

Scenario: Let’s take my GlobalTech, my giant imaginary company with €500M annual revenue, operations in 12 countries.

Before MCNP:

- €75M cash spread across 45 accounts

- €22.5M idle cash (30% of total)

- Monthly overdraft fees: €125,000

- FX transaction costs: €180,000 annually

- Manual reconciliation: 120 hours/month

- Total Annual Cash Management Cost: €2.1M

After MCNP Implementation (Conservative Scenario):

- €70M effectively deployed cash

- €12M idle cash (17% of total – not 8% as vendors claim)

- Monthly overdraft fees: €40,000 (not €25,000 – banks still charge for facilities)

- FX transaction costs: €135,000 annually (25% reduction, not 50%)

- Manual reconciliation: 60 hours/month (automation helps but doesn’t eliminate)

- Annual MCNP Bank Fees: €180,000

- Implementation Costs: €500,000 (year 1)

Net Result:

- Year 1 Savings: €800,000 (160% ROI)

- Ongoing Annual Savings: €1.2M

- Break-even: 8 months

Pessimistic Scenario (What Can Go Wrong):

- Implementation delays add €200,000 in consulting costs

- Bank pricing increases 30% after year 2

- Regulatory changes require expensive restructuring

- Actual Year 1 ROI: 80%

- Break-even: 14 months

You’ll find here a downloadable file the full calculation behind these figures, including a clear breakdown of the “before” and “after” scenarios. To keep the article concise, I’ve excluded the detailed numbers from the main text and included them separately for your reference.

DISCLAIMER: The calculations (in the file) are based on real industry data, but every company’s results will vary based on:

- Current cash management sophistication

- Geographic complexity

- Currency restrictions

- Implementation quality

- Organizational discipline

Technology Requirements: Your Realistic Shopping List

Banking Technology:

- Real-time MCNP platform supporting your currencies

- Bank connectivity

- Regulatory reporting for all jurisdictions

Integration Technology:

- Connectors for your ERP and TMS systems

- Multiple data transfer protocols (SFTP, API, H2H)

- Strong user access controls and audit trails

Monitoring Technology:

- Real-time cash positioning dashboards (if possible)

- Automated exception reporting

- Manual override capabilities (for when automation fails)

Implementation Success Factors

Week 1-4 Action Items:

- Map your current account structure and identify regulatory restrictions

- Calculate current idle cash levels and overdraft costs

- Assess internal IT and treasury capabilities honestly

- Request detailed proposals from 3+ major banks

Technology Readiness Checklist:

- ERP system with treasury module capability

- Dedicated IT resources for implementation months (if it’s a new bank, or you add functionalities to existing setup)

- Treasury team with system integration experience

- Fallback procedures for system failures

Risk Mitigation:

- Start with 2-3 major currencies before expanding

- Maintain traditional credit facilities as primary backup

- Implement gradual exposure increases over 12 months

- Establish clear reversion procedures if MCNP fails

The Technology Reality Check

What You DON’T Need:

- Custom software development (usually)

- Dedicated IT staff permanently assigned to treasury

- Coding knowledge (but technical aptitude helps)

What You DO Need:

- Strong banking relationship with proven MCNP capability

- ERP system with treasury modules and integration budget

- Committed IT support for several months

- Patience for a complex implementation process

When MCNP Implementations Fail

Common Failure Patterns:

- Underestimating regulatory complexity: Pooling restrictions discovered late in implementation

- Bank system limitations: Promised functionality doesn’t work as advertised

- Internal resource constraints: Treasury team overwhelmed by lack of knowledge

- Cost overruns: Implementation costs 2-3x initial estimates

Warning Signs:

- Bank cannot provide reference clients in your industry

- Implementation team lacks local regulatory expertise

- IT integration timeline seems unrealistic

- No clear rollback plan if implementation fails

Alternative Approaches to Consider

Physical Cash Pooling:

- Pros: Simpler implementation, lower bank dependency

- Cons: Higher FX costs, more complex accounting

- Best For: Companies with strong regional treasury centers

Multi-Bank Approach:

- Pros: Reduces single bank dependency, competitive pricing

- Cons: More complex integration, limited netting benefits

- Best For: Large corporations with sophisticated treasury operations

Hybrid Solutions:

- Pros: Combines MCNP benefits with risk diversification

- Cons: Higher complexity, increased management overhead

- Best For: Companies transitioning from fragmented to centralized treasury

Next Steps: Your 60-Day Action Plan

Days 1-14: Assessment and Planning

- Document current cash management costs and inefficiencies

- Assess internal capabilities and resources honestly

- Identify regulatory constraints in key markets

- Build preliminary business case with conservative assumptions

Days 15-30: Market Research

- Request detailed proposals from 3+ banks

- Interview existing MCNP clients in your industry

- Assess technology integration requirements

- Validate regulatory compliance requirements

Days 31-45: Decision Framework

- Build comprehensive business case with multiple scenarios

- Assess implementation risks and mitigation strategies

- Evaluate alternative approaches

- Define success metrics and exit criteria

Days 46-60: Go/No-Go Decision

- Present findings to management with honest risk assessment

- Secure adequate budget and resources for full implementation

- Establish project governance and oversight

- Make the decision to proceed only if conditions are right

The Bottom Line

MCNP can deliver significant value when implemented correctly by the right organizations. The key is honest assessment of your situation, realistic expectations about implementation complexity, and thorough risk management.

The question isn’t whether MCNP is a good idea in theory—it’s whether your organization has the cash volumes, capabilities, and risk tolerance to implement it successfully. For companies with the right profile, MCNP can become a competitive advantage. For others, simpler cash management solutions may deliver better risk-adjusted returns.

Critical Success Factor: Be brutally honest about your organization’s capabilities and constraints. MCNP success requires more than good intentions—it requires execution excellence across treasury, IT, and banking relationships.

Ready to Quantify Your MCNP Opportunity?

You’ve learned the theory—now discover the numbers that matter for your organization. You can use the interactive MCNP free tools to model the exact financial impact of implementing multi-currency notional pooling with your specific parameters.

Calculate your potential:

- Interest optimization from consolidated cash positions

- Overdraft elimination through virtual concentration

- FX cost reduction via automated netting

- Process efficiency gains from manual task elimination

Test multiple scenarios from conservative to optimistic assumptions, customize implementation costs, and generate a comprehensive business case in under 5 minutes.

Launch MCNP Sensitivity Analysis ROI Calculator.

Launch MCNP Business Case ROI Calculator.

Launch the Cash Pool Simulator Calculator.

No registration required. It’s free. No data stored.