Pricing and yields are fundamental concepts in evaluating the performance and attractiveness of short-term investments. Understanding how these metrics are calculated and interpreted helps investors optimize their portfolios and align their investment strategies with liquidity and risk management goals. This chapter provides a comprehensive guide to pricing mechanisms, yield calculations, and their applications in managing short-term investments.

- Basics of Pricing for Short-Term Investments

1.1 What Determines the Price?

- Market Factors:

- Prevailing interest rates.

- Credit risk of the issuer.

- Time to maturity.

- Instrument Type:

- Pricing varies depending on the structure of the investment (e.g., discount instruments like Treasury Bills versus interest-bearing instruments like Certificates of Deposit).

1.2 Price and Yield Relationship

- Price and yield are inversely related:

- When yields rise, prices fall.

- When yields fall, prices rise.

1.3 Discount Instruments

- Sold at a discount to face value, with the difference representing the investor’s return.

- Examples: Treasury Bills (T-Bills), Commercial Paper.

1.4 Interest-Bearing Instruments

- Sold at par or a premium/discount, with periodic interest payments (coupons).

- Examples: Short-term bonds, Certificates of Deposit (CDs).

- Calculating Prices for Short-Term Investments

2.1 Discount Instruments

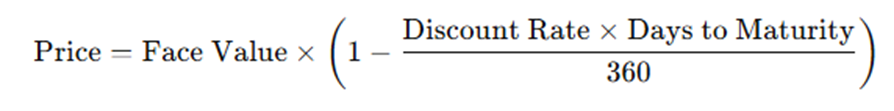

- Formula:

- Example:

- A T-Bill with a face value of $1,000, a discount rate of 3%, and 90 days to maturity:

2.2 Interest-Bearing Instruments

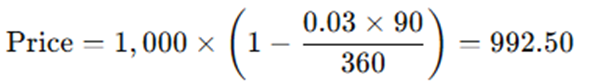

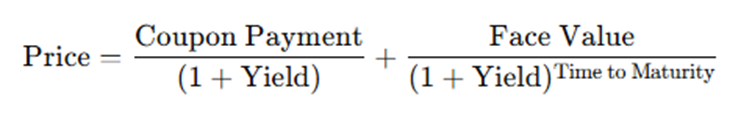

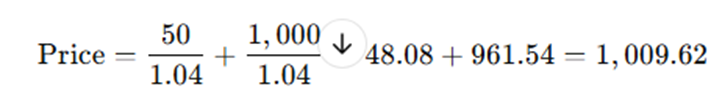

- Formula:

- Example:

- A bond with a face value of $1,000, a 5% annual coupon, 1 year to maturity, and a yield of 4%:

- Yields on Short-Term Investments

3.1 Definition

- Yield measures the return on investment expressed as an annual percentage. It allows investors to compare the profitability of different instruments.

3.2 Types of Yields

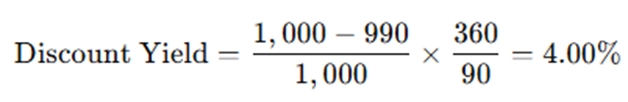

- Current Yield

- Applies to interest-bearing instruments.

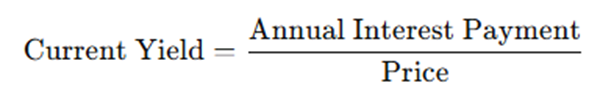

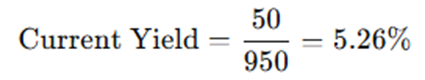

- Formula:

- Example: A bond priced at $950 with a $50 annual coupon:

- Yield to Maturity (YTM)

- Considers total return, including interest payments and the difference between purchase price and face value.

- Purpose: Useful for comparing bonds with different prices and maturities.

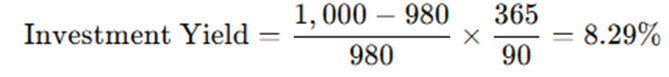

- Discount Yield

- Common for T-Bills and other discount instruments.

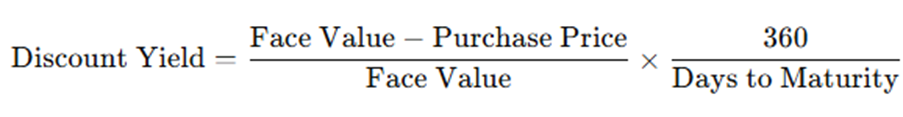

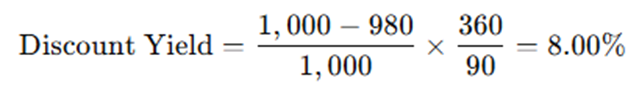

- Formula:

- Example: A T-Bill priced at $980 with a face value of $1,000 and 90 days to maturity:

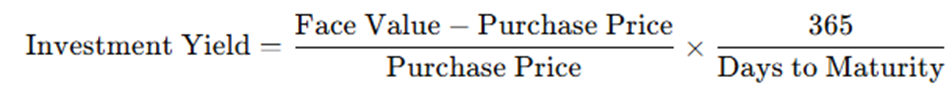

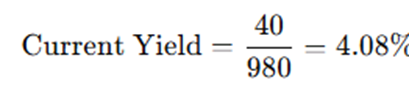

- Investment Yield (or Bond Equivalent Yield)

- Converts discount yield to a more comparable annualized yield.

- Formula:

Example: Using the same T-Bill:

- Factors Influencing Yields

4.1 Interest Rates

- Higher rates typically result in higher yields and lower prices.

4.2 Credit Risk

- Instruments with higher risk offer higher yields to compensate investors.

4.3 Liquidity

- Highly liquid investments (e.g., T-Bills) tend to offer lower yields due to reduced risk.

4.4 Inflation

- Investors demand higher yields during periods of rising inflation to preserve purchasing power.

- Strategies for Maximizing Yields

5.1 Laddering

- Invest in instruments with staggered maturities to benefit from higher rates over time.

5.2 Diversification

- Spread investments across instruments with varying risk profiles to optimize risk-adjusted returns.

5.3 Active Management

- Regularly adjust portfolios based on changing market conditions and yield opportunities.

5.4 Reinvestment

- Reinvest matured funds promptly to maintain compounding benefits.

- Tools for Pricing and Yield Analysis

6.1 Financial Calculators

- Tools like HP 12C or online calculators to compute yields and prices.

6.2 Spreadsheet Models

- Use Excel formulas to calculate yields and perform sensitivity analyses.

6.3 Market Platforms

- Platforms like Bloomberg Terminal provide real-time yield and price data.

6.4 Investment Apps

- Tools like Morningstar and Robinhood offer insights into yields and pricing for retail investors.

- Case Study: Comparing Two Short-Term Instruments

Scenario:

- Instrument A: T-Bill priced at $990 with a face value of $1,000 and 90 days to maturity.

- Instrument B: Corporate bond priced at $980 with a $1,000 face value, a 4% annual coupon, and 180 days to maturity.

Calculations:

- T-Bill Yield:

- Discount Yield:

- Corporate Bond Current Yield:

- Current Yield:

Interpretation:

- The corporate bond offers a slightly higher yield but carries additional credit risk. The T-Bill is safer but with a lower return.

- Emerging Trends in Pricing and Yield Management

8.1 Sustainability and ESG

- Green bonds and ESG-compliant investments offer competitive yields with a focus on sustainability.

8.2 Digital Innovations

- Blockchain-based tokenized securities provide transparent pricing and real-time yield updates.

8.3 Dynamic Yield Adjustments

- AI-driven platforms adjust pricing and yield recommendations based on real-time market data.

Conclusion

Pricing and yields are fundamental to evaluating short-term investments. By understanding the factors that influence these metrics and applying the appropriate calculations, investors can optimize their portfolios for liquidity, safety, and returns. As financial markets evolve, leveraging advanced tools and strategies will remain essential for navigating the complexities of short-term investments effectively.

Leave a Comment

You must be logged in to post a comment.