Introduction

Tax considerations are a critical aspect of treasury management. As stewards of an organization’s financial operations, treasury professionals must navigate complex tax environments while optimizing cash flow, ensuring compliance, and minimizing costs. This chapter explores the key tax considerations for treasury, including corporate tax structures, transfer pricing, withholding taxes, value-added tax (VAT), and the implications of international operations.

1. The Role of Tax in Treasury

Treasury management involves maximizing the efficiency of cash flow and financial resources. Tax considerations are integral to this role for several reasons:

- Cash Flow Impact: Taxes directly affect the timing and availability of funds for operations and investments.

- Compliance and Risk Management: Mismanagement of tax obligations can lead to penalties, reputational damage, and inefficiencies.

- Cost Minimization: Effective tax strategies can reduce overall tax liabilities, increasing profitability.

Treasury’s collaboration with the tax department ensures strategic alignment and compliance.

2. Corporate Tax Structures

Corporate tax is a primary concern for treasury operations, as it influences decisions about where and how to allocate resources. Key considerations include:

a. Effective Tax Rate (ETR) Management

The effective tax rate is the percentage of income paid as tax, considering deductions, credits, and incentives. Treasury may work with tax professionals to:

- Identify jurisdictions with favorable tax regimes.

- Optimize tax attributes such as net operating losses (NOLs).

- Use tax credits and incentives to reduce liabilities.

b. Entity Structuring

Global corporations may utilize structures such as holding companies, subsidiaries, or branches to optimize taxation. Treasury must consider:

- Tax treaties between jurisdictions.

- The impact of tax reforms on existing structures.

- Repatriation costs and restrictions.

3. Transfer Pricing

Transfer pricing refers to the pricing of goods, services, or loans exchanged between related entities. It is a major focus for tax authorities globally. Treasury implications include:

- Intercompany Financing: Loans between subsidiaries must comply with arm’s-length principles to avoid tax penalties.

- Documentation Requirements: Many countries require detailed documentation to justify transfer pricing practices.

- Tax Optimization: Properly structured transfer pricing policies can reduce taxable income in high-tax jurisdictions.

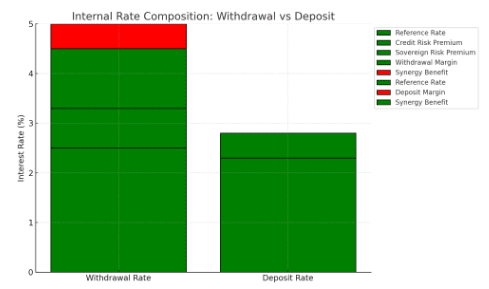

For a deeper understanding of how internal funding costs are structured and allocated across entities, explore our comprehensive guide on Treasury Transfer Pricing. It breaks down the methodologies, rate components, and technology tools needed to build a compliant and efficient internal pricing framework.

4. Withholding Taxes

Withholding taxes are levied on cross-border payments such as dividends, interest, and royalties. Treasury teams must manage these to avoid unnecessary tax burdens:

- Tax Treaty Benefits: Utilize applicable tax treaties to reduce withholding tax rates.

- Timing Considerations: Strategize payment timing to optimize tax benefits.

- Compliance Obligations: Ensure accurate reporting to prevent penalties.

5. Value-Added Tax (VAT) and Sales Taxes

Treasury also plays a role in managing VAT and sales taxes:

- Cash Flow Impact: Timing of VAT payments and refunds can influence liquidity.

- Cross-Border Transactions: Import/export operations may trigger VAT liabilities or require documentation for exemptions.

- Compliance Management: Ensuring accurate filings across jurisdictions minimizes financial and reputational risks.

6. International Tax Considerations

For multinational corporations, international tax considerations are paramount:

a. Base Erosion and Profit Shifting (BEPS)

The BEPS initiative by the OECD aims to prevent tax avoidance through profit shifting. Treasury must:

- Adapt to country-specific implementations of BEPS actions.

- Reassess transfer pricing and intercompany financing structures.

b. Global Minimum Tax

The introduction of a global minimum tax (e.g., OECD’s Pillar Two) requires treasury to:

- Understand jurisdiction-specific implementations.

- Adjust profit allocation and tax planning strategies.

c. Currency and Taxation

Exchange rate movements can affect taxable income and require careful management to mitigate tax volatility.

7. Tax Implications of Treasury Transactions

Treasury transactions, such as hedging and investments, often have tax implications:

a. Derivatives and Hedging

- Tax Treatment: Gains and losses on hedges may be taxable in different periods than the underlying exposure.

- Documentation: Proper documentation ensures tax authorities recognize hedging as legitimate risk management.

b. Cash Pooling

- Cross-Border Taxation: Centralized cash pools may trigger tax liabilities, including withholding taxes and transfer pricing adjustments.

- Thin Capitalization Rules: Limits on debt-to-equity ratios may restrict intercompany lending.

c. Debt Financing

- Interest Deductibility: Tax laws often limit interest expense deductions, affecting funding strategies.

- Hybrid Instruments: Instruments with both debt and equity characteristics may face different tax treatments in different jurisdictions.

8. Tax Technology in Treasury

Advancements in technology enable treasury teams to manage tax considerations more effectively:

- Automation of Tax Reporting: Reduces errors and improves compliance.

- Real-Time Tax Analysis: Enables proactive decision-making in response to regulatory changes.

- Integration with Treasury Management Systems (TMS): Streamlines tax calculations for treasury transactions.

9. Compliance and Risk Management

Treasury professionals must stay informed about changing tax regulations. Key strategies include:

- Regular Training: Ensure teams understand evolving tax laws.

- Collaboration with Tax Experts: Work closely with tax teams to align on compliance and strategy.

- Scenario Analysis: Evaluate the tax implications of different treasury strategies under various regulatory scenarios.

Conclusion

Tax considerations are integral to treasury management, influencing cash flow, profitability, and compliance. A proactive approach to understanding and managing tax obligations ensures the organization operates efficiently and minimizes risk. By staying informed about evolving tax environments and leveraging technology, treasury teams can navigate complexities and add strategic value.

Leave a Comment

You must be logged in to post a comment.