What is Treasury Technology?

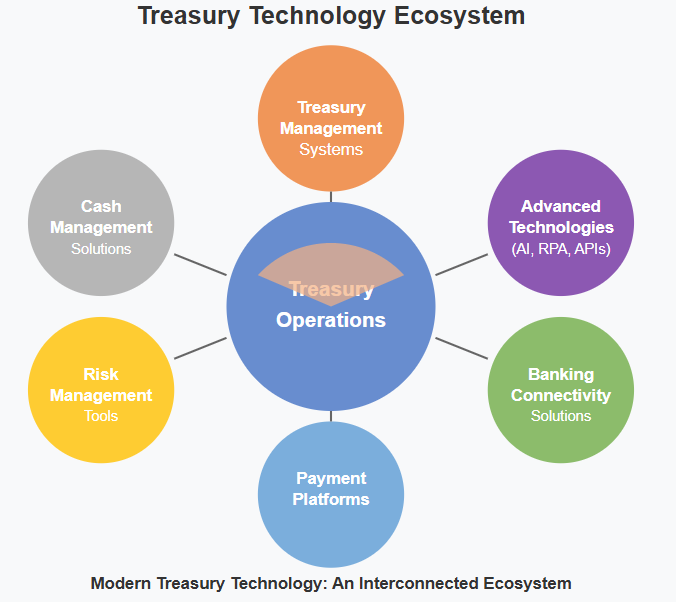

Treasury Technology is the integrated ecosystem of systems, tools, platforms, and infrastructure that supports the management of a company’s cash, liquidity, risk, banking relationships, and financial operations. Far more than just a single software platform, it encompasses:

- Specialized software (Treasury Management Systems, cash forecasting tools)

- Integrated technologies (APIs, RPA, AI, blockchain)

- Analytics solutions (data visualization, business intelligence)

- Security frameworks (payment fraud prevention, cybersecurity)

- ERP modules and extensions that connect treasury to the broader finance function

In essence, Treasury Technology is the digital backbone that enables modern treasury departments to operate efficiently, securely, and with real-time insights. It transforms traditionally reactive treasury roles into proactive strategic functions.

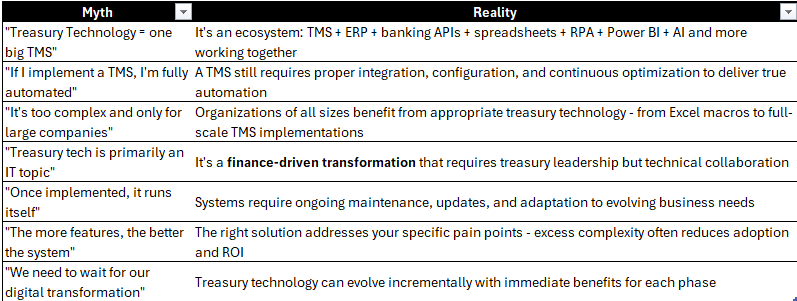

Common Myths vs. Reality in Treasury Technology

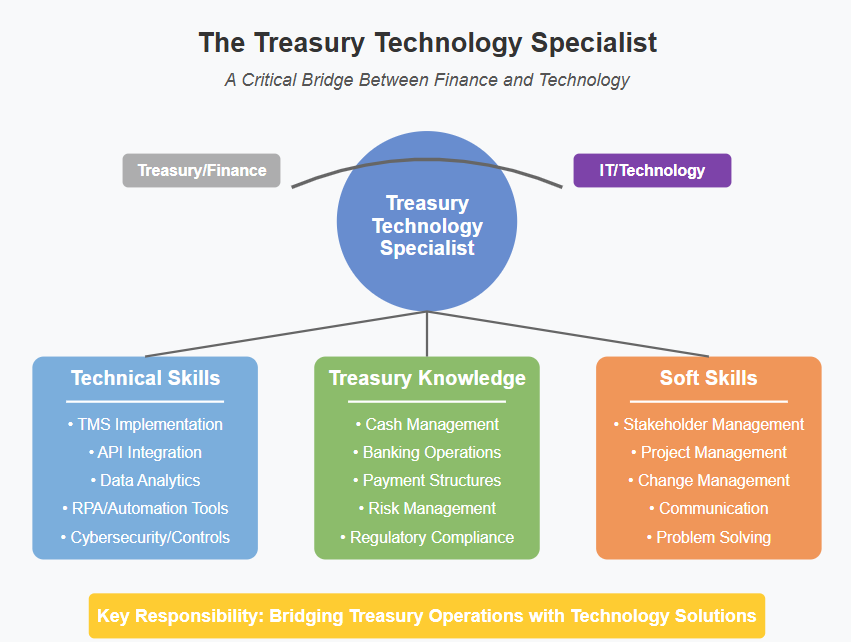

The Rise of the Treasury Technology Specialist

A Treasury Technology Specialist is a professional who bridges the critical gap between treasury operations and technology solutions. They understand Treasury, they worked as Treasurers, they can design, implement, manage, and optimize the systems that support modern treasury functions.

This role is becoming increasingly valuable yet remains relatively rare in the market. While traditional treasury roles focus on cash management, liquidity, and financial risk, technology specialists focus on:

- Selecting and implementing appropriate Treasury Management Systems

- Designing integration architectures for banking platforms, ERP systems, and APIs

- Automating manual processes through RPA, Power Automate, and other tools

- Enhancing data visibility through reporting solutions and dashboards

- Translating between treasury users and IT teams

- Staying ahead of emerging technologies (AI, real-time payments, ISO 20022)

- Building resilient and secure treasury infrastructure

Organizations that recognize the importance of this role gain a significant competitive advantage. The Treasury Technology Specialist doesn’t just maintain systems but continuously evolves the treasury function’s capabilities, enabling true transformation rather than mere digitization.

A Treasury Technology Specialist should develop proficiency in several critical platforms and tools that power modern treasury operations. Essential systems include

- Treasury Management Systems (TMS) like Coupa, Kyriba, FIS Quantum, ION Treasury, etc for core treasury functions.

- For data analysis and reporting, mastery of Microsoft Power Platform (Power BI, Power Automate), SQL, and Python is invaluable.

- Robotic Process Automation (RPA) tools such as Power Automate, UiPath, Blue Prism, or Automation Anywhere can significantly enhance operational efficiency.

- For cash management and forecasting, familiarity with SAP Treasury, Oracle APEX, and Wall Street Systems is beneficial.

- Payment systems expertise should include SWIFT, SEPA, and Ripple technologies.

- Understanding blockchain applications for treasury (like R3 Corda), API integration capabilities, and cybersecurity frameworks will position specialists at the forefront of treasury innovation.

- ERP system knowledge, particularly SAP and Oracle modules that interface with treasury functions, rounds out the necessary technical toolkit.

- AI technologies like machine learning algorithms for cash forecasting and predictive analytics are revolutionizing treasury operations. Retrieval Augmented Generation (RAG) systems are being deployed to create intelligent treasury assistants that can access and interpret treasury policies, financial regulations, and historical transaction data. Large Language Models (LLMs) from OpenAI, Anthropic, and Microsoft are being integrated into treasury workflows for contract analysis and regulatory compliance monitoring.

- Additionally, intelligent document processing platforms from ABBYY and Kofax are streamlining treasury documentation workflows.

The Treasury Event Landscape: A Balanced Perspective

The treasury conference and webinar circuit plays an important role in our professional ecosystem. These events offer valuable networking opportunities and exposure to established practices. However, you should approach them with a balanced perspective:

- Recognize presentation contexts: Vendor demonstrations naturally showcase ideal scenarios with perfectly cleansed data – real implementations involve additional complexities

- Look beyond features to outcomes: The most impressive features may not address your specific operational needs

- Seek diverse perspectives: The most valuable insights often come from peer discussions around practical implementation challenges

- Consider the source: Presentations labeled as “educational” may still have product-focused objectives

- Balance established and emerging views: Both traditional approaches and innovative perspectives have their place in treasury evolution

As our profession evolves, there’s opportunity to enrich these conversations with more diverse organizational perspectives, candid implementation discussions, and interactive formats that facilitate knowledge exchange beyond presentations.

Selecting the Right Treasury Technology: A Pragmatic Approach

When evaluating treasury technology, consider:

- Process First, Technology Second: Start by mapping and optimizing your treasury workflows. Technology amplifies good processes but can’t fix fundamentally broken ones. Remember: NEVER IMPLEMENT NEW TOOLS ON OLD PROCESSES.

- Integration is Everything: The most elegant solution fails if it can’t communicate effectively with your ERP, banking systems, and other financial platforms.

- Start With Pain Points: Address your most significant operational challenges first rather than implementing technology for its own sake.

- Consider Total Resource Requirements: Beyond license costs, factor in implementation time, internal resources needed, and ongoing support.

- Security and Controls: Treasury manages significant financial risks – ensure technology enhances rather than compromises your control environment.

- Scalability: Choose solutions that can grow with your organization’s evolving needs and transaction volumes.

- User Experience: The most sophisticated solution fails if your team struggles to use it effectively.

Implementation Keys to Success

Successful treasury technology implementations typically:

- Start with clearly defined objectives and success metrics

- Include all treasury team members from the start – never just managers. Managers decide, but teams execute, and they often understand the practical realities best.

- Roll out changes in manageable phases rather than “big bang” approaches

- Include thorough testing with real-world data and scenarios

- Incorporate adequate training and change management

- Plan for post-implementation optimization

- Document processes and create knowledge transfer mechanisms

Looking Ahead: The Future Treasury Technology Landscape

The treasury technology landscape continues to evolve with:

- API-first architectures replacing traditional file-based integration

- Real-time capabilities across payments, reporting, and forecasting

- AI and machine learning enhancing prediction accuracy and anomaly detection

- Enhanced visualization making complex data more accessible to stakeholders

- Embedded treasury components within broader financial platforms

- Convergence of treasury and broader finance technology ecosystems

The right treasury technology transforms operations by providing better visibility, control, and decision-making capabilities. By approaching treasury technology with both openness to innovation and healthy pragmatism, treasurers can make choices that truly advance their functions and contribute positively to their organizations’ financial strategy.

The most successful treasury technology implementations aren’t about having the latest features or most sophisticated tools. They’re about having the right solutions for your specific challenges, well-integrated with your existing environment, and supported by people who understand both the technology and treasury operations.

As treasury professionals, we benefit from being informed consumers of technology, balancing established practices with emerging innovations, and focusing on outcomes rather than features. This approach leads to treasury technology that truly delivers on its promise.

Leave a Comment

You must be logged in to post a comment.